PDFelement-Powerful and Simple PDF Editor

Get started with the easiest way to manage PDFs with PDFelement!

When running a successful business, the time will come to switch from driving your vehicle to a business vehicle. However, business car finance is not limited to large corporations. Personal-type vehicles and small delivery vehicles must be financed for work-related use by small businesses, consultants, and salespeople. Consider what factors may affect your rate, who will finance the vehicle, and what documents you need before applying for a business car loan.

A PDF editor can help you easily handle car loan files in PDF format. Learn how to edit and fill PDF forms with the best PDF solution for small businesses.

In this article

Part 1. What Is a Business Auto Loan?

Business auto loans, for the most part, function similarly to consumer auto loans. The vehicle is collateral when you borrow money to buy a car or truck.

This means that, unlike other business loans, you may not be required to sign a personal guarantee promising to repay the debt with personal assets if your company fails. Because the built-in collateral reduces the lender's risk in the transaction, these loans typically have lower interest rates than unsecured business loans.

Part 2. Do You Need a Car for Your Business?

Not all transactions are completed over the phone or by customers walking into your store. A vehicle is frequently required to accomplish and complete business actions and transactions.

A business auto lease may be better if you only need the car for a short period or expect to use it infrequently. Leasing may also be a good option for business owners who require a high-end or luxury vehicle but cannot afford to buy it outright. However, buying may be the better option if you plan to put many miles on the car or keep it for a long time.

If you intend to apply for business car finance soon, improve your future borrowing potential by following simple guidelines today.

1. Enhance your credit score.

Improve your credit score before applying for a loan. Check that all of your bills are paid and correct any errors, such as incorrect information that may appear on them. Maintain a low credit limit to demonstrate that you can responsibly manage money lent to you.

2. Select the best lender.

Apply to a lender who fits your requirements and is more likely to accept you. Different lenders have different requirements and approaches to risk, just as there are different loans for different needs.

3. Get a low-interest business auto loan.

Unaffordable loans are not in your best interests and are unappealing to lenders. A bank or lender wants to know that you can repay the loan. Determine how much you require, check to see if you qualify, and then apply for the minimum loan amount.

4. Know the loan procedure.

What you need to start and finish the process depends on the type of loan you're applying for. Understanding what is required, when it must be submitted, and how long it takes will allow you to adequately prepare and manage expectations.

5. Pay off your other loans and debts.

Your debt-to-income ratio is an important component of your credit score: the amount of credit you used versus what is available to you. A high ratio may indicate that you are overexposed to debt, reducing your chances of obtaining a new loan. Paying off debt will reduce this ratio, making your application more appealing.

6. Make a collateral suggestion.

If you're having trouble getting a loan, you can put down collateral to show the lender that you're serious and have the incentive to repay the money or risk losing that valuable item.

7. Introduce a trustworthy co-signer.

If you're just getting started or have a higher debt-to-income ratio, you can also have someone with a good credit score or a higher income co-sign the loan application.

8. Tell the truth.

Overestimation of income, underestimation of debt, or misrepresentation of employment may result in your application being rejected and your credit score declining.

9. Fill out the business car loan application form clearly.

When completing a loan application form, paying close attention to detail is critical. Filling out an application entails far more than simply filling in the blanks. You should examine the application from the perspective of your potential lender.

The majority of business auto loan application forms are available in PDF format. They are downloadable and must be printed to be filled out. However, there is a way to fill out a business car loan application online.

Wondershare PDFelement is a powerful PDF editor with a comprehensive set of tools for reading, editing, converting, annotating, signing, and sharing PDFs. It facilitates working with PDF files and enables you to create professional-looking PDF documents and forms quickly, affordably, and securely.

How To Fill Out Business Car Loan Application Form

Here's how to edit PDF forms with Wondershare PDFelement.

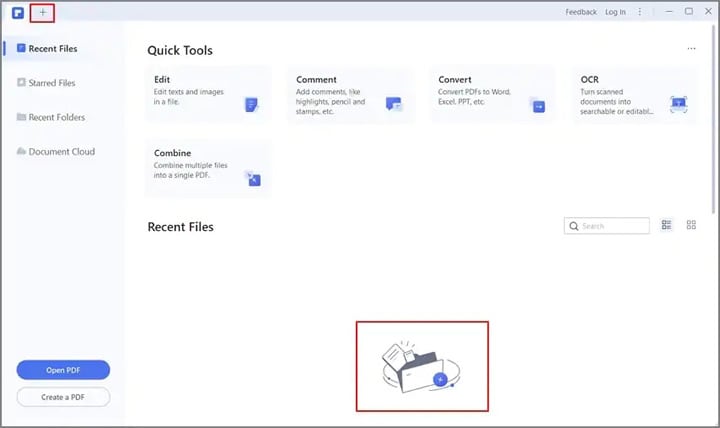

Step 1Open the PDF form

To begin editing PDF form fields, open the document. To import the PDF form, go to the Home window and click the "Open PDF" button.

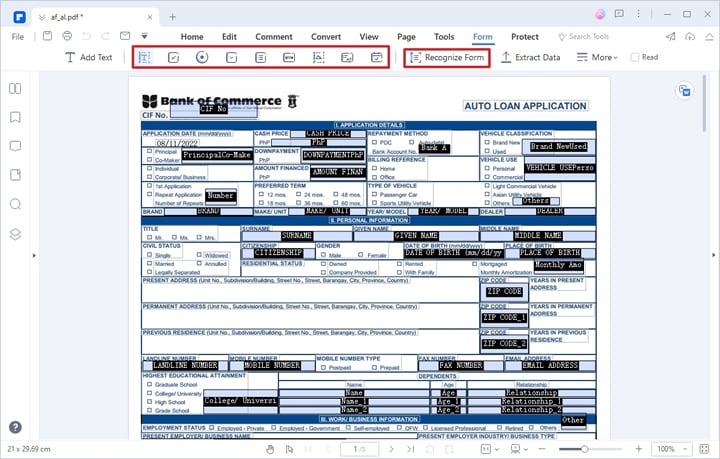

Step 2xxAdd interactive form fieldsx

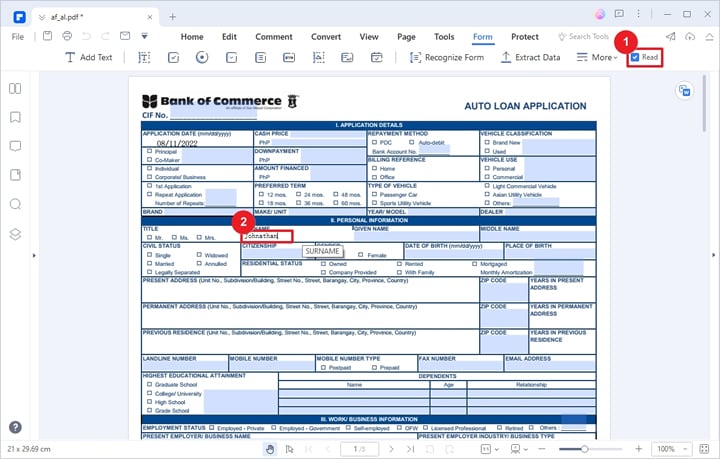

Click on the "Form" tab in the main menu toolbar, then select the "Recognize Form" option to add interactive text fields to the form. You can choose other field tools to add text fields, checkbox fields, signature fields, or others to the form manually. Double-click on the text field to open a dialogue box (text field properties) where you can make changes to the field.

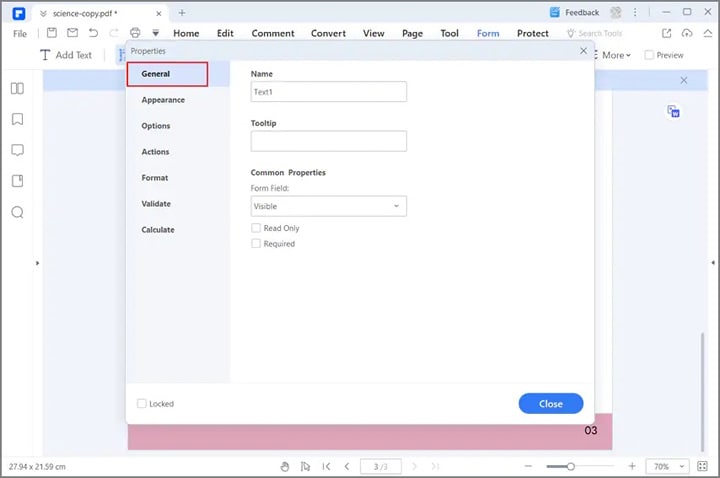

Step 3Customize the form

The "Appearance" tab allows you to change the color, font size, style, and font color of the form field. The other tabs on this window provide additional customization options. When you're finished, click "Close".

Step 4Fill out the application form

After adding the form fields, tick the "Read" option. Then, click on the interactive form fields to fill out the form accordingly.

Part 4. 7 Business Car Loan Lender Options

A secured business car loan means that if you default, the lender can repossess the vehicle. Commercial auto loans have lower interest rates than personal ones and may include additional benefits such as flexible repayment terms.

A good credit score and a strong business financial history are usually required to qualify for a business auto loan. You must also select a reputable business car loan provider. Let's look at the list of business auto loan providers below to find the best one for your specific needs:

1. Bank of America Business Auto Loan

Customers who want to buy or refinance a car can get a car loan from Bank of America. Interest rates begin at 3.99%, and loan amounts begin at $10,000. The loans can be used to purchase or refinance automobiles, light commercial trucks, and vans. The repayment term ranges from four to six years, and the business vehicle can be up to five years old with a mileage limit of up to 75,000 miles. There is no set minimum credit score or time in business requirement.

2. Ally Bank Business Auto Loan

Ally Bank is an excellent choice for financing your car lease. They provide flexible leases, no personal guarantees, and heavy-duty trucks and vehicle modification loans. Furthermore, they only provide financing in the business's name, so you may not be held liable for any loan nonpayment.

3. Capital One Business Auto Loan

Capital One is an excellent choice for a business loan. They provide loans starting at $10,000 with repayment terms of up to five years. To qualify, you must have a Capital One business checking account or be willing to open one, and your company must have been in operation for at least two years.

4. Wells Fargo Commercial Auto Loan

Wells Fargo is a reputable lender that offers a wide range of loan products. Their initial APR is 6.25%, and there are no origination or maintenance fees. There are no prepayment penalties or termination fees; the only other fee is a $150 documentation fee. Loan amounts range from $10,000 to $100,000, with repayment terms extending to 84 months.

5. Angle Auto Finance

Angle relies heavily on brokers to originate loans, so if you want a car loan, you'll have to go through a broker. To be eligible for a loan with Angle Finance, you must be 18 years old and have a credit score of at least 600. Furthermore, your company must have been operating for at least two years. If you are approved for a loan with Angle Finance, you will not be required to provide any financials (including bank statements) to approve your loan, making it a low-documentation lender.

6. Chase Bank Business Auto Loan

Chase Bank provides auto loans for new and used vehicles, except for commercial vehicles and some exotic ones. According to our research, auto loan rates for borrowers with excellent credit can start as low as 3.54%. Chase auto loans do not require a down payment. Furthermore, Chase does not provide auto refinancing.

7. Lombard Car Finance

Lombard is one of the UK's oldest and largest asset finance partners. Today, Lombard continues to take a forward-thinking, entrepreneurial approach, assisting businesses in obtaining the vehicles, machinery, equipment, technology, marine vessels, and aircraft they require to operate efficiently.

Conclusion

A business auto loan enables you to purchase a vehicle in your or your company's name and then pay the lender a fixed monthly repayment. It may aid in the growth of your business, but it is critical that you understand what is required and how it may affect your business and personal life.