All You Need To Know About 1099 INT

The IRS Form 1099 is a series of documents used for reporting various types of income, payments, and transactions. One type of this document is the Form 1099 INT. This one is for reporting interest income paid to individuals or entities by banks, financial institutions, or other payers.

Do you think you're qualified to receive a Form 1099 INT? Here is your guide on how to download it from your bank. Also, we will introduce you to the best tool for reviewing and printing the form: Wondershare PDFelement.

In this article

Part 1. What Is 1099 INT Form Used For?

Form 1099 INT is a form used for enforcing tax laws in the United States. The "INT" means interest. That said, it is an information return used to report interest income paid to individuals or entities. Who issues these forms? That would be banks, financial institutions, or other payers. So, unless you work for a bank, you would never need to fill out a form 1099 INT.

Please note that even if you received interest income, it's possible that you would not receive a Form 1099 INT. Only people or entities who received equal to or more than $10 in interest in the tax year will receive a Form 1099 INT.

What is the taxing rate for taxable interest? It shares the same rate as ordinary income. Ordinary income pertains to income from sources such as salaries, wages, tips, and self-employment income.

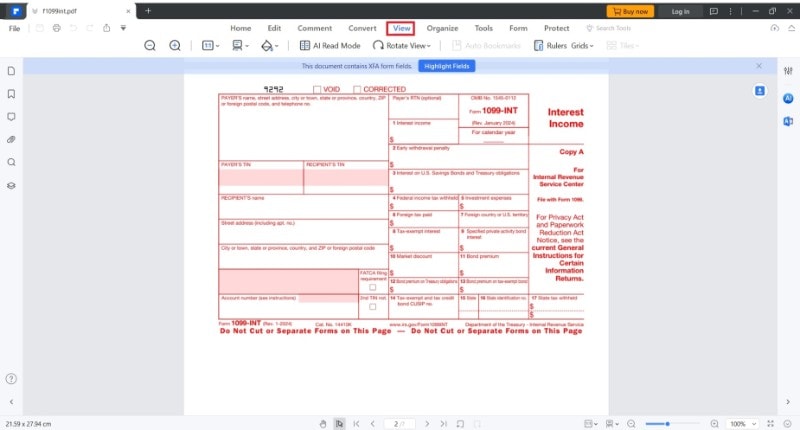

Part 1.1. What Could be Reported on a Form 1099 INT?

That is a good question. The most common one is interest on bank deposits. But it is not limited to that. Indebtedness issued in registered form can also be reported on a Form 1099 INT. Likewise, indebtedness in bonds, debentures, and notes could be reported. It applies to certificates, too, but those of the U.S. Treasury are an exception.

Accumulated dividends paid by a life insurance company will also appear on a Form 1099 INT.

Suppose federal income tax or foreign tax were withheld. The amounts from which they were withheld will also be on a Form 1099 INT.

While not as common as the ones listed above, these records can also be recorded on Form 1099 INT.

If a real estate mortgage investment conduit (REMIC) has accrued enough interest, it will be on a Form 1099 INT. The same goes for income received by the regular interest holder from a Financial Asset Securitization Investment Trust (FASIT). This is treated as interest income; thus, it can be reported on a Form 1099 INT.

Part 2. How To Download a Bank of America Form 1099 INT?

If you are using the bank's online banking app, you can get your Form 1099 INT from there. If you can't find one, it means you haven't reached the threshold. Here, we will discuss how to download a Form 1099 INT from different banks.

Part 2.1. Download Bank of America Form 1099 INT

- Sign in to Bank of America's Online Banking.

- Select your Deposits account.

- Click the Statements & Documents tab.

- Find the Form 1099 INT and download it.

Part 2.2. Download Chase Bank 1099 INT

- Log into your Chase online banking account.

- Click Customer Center.

- Click Order 1099.

- Select the 1099-Int document and download it.

Part 2.3. Download PNC 1099 Int

- Log into your PNC Online Banking account.

- Go to the Customer Service tab.

- Click Online Documents.

- Find the Form 1099 INT and download it.

Please note that these banks also send the Form 109y9 INT through mail. They mail it on January 31st of each year.

Part 3. How To Fill Out 1099 Form for Interest Income

Suppose you are working for banks, investment houses, and other interest-paying entities. You are tasked to prepare 1099 INT forms. Here is your guide on how to fill out a Form 1099 Form. Recipients can also learn a thing or two from here.

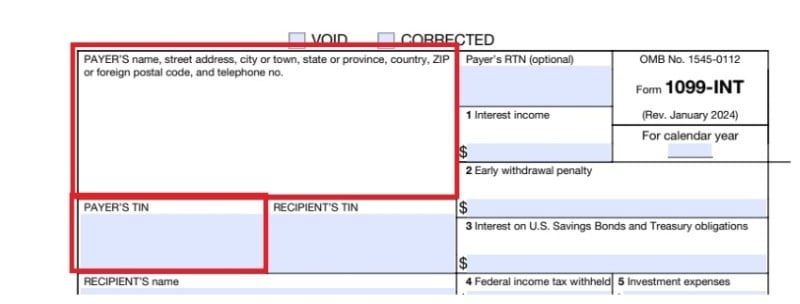

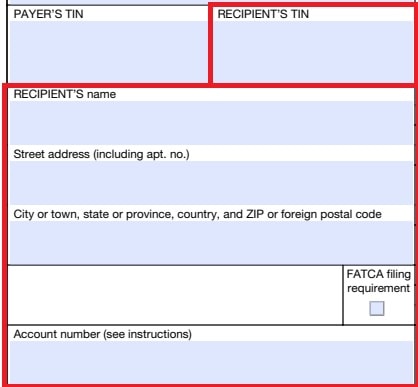

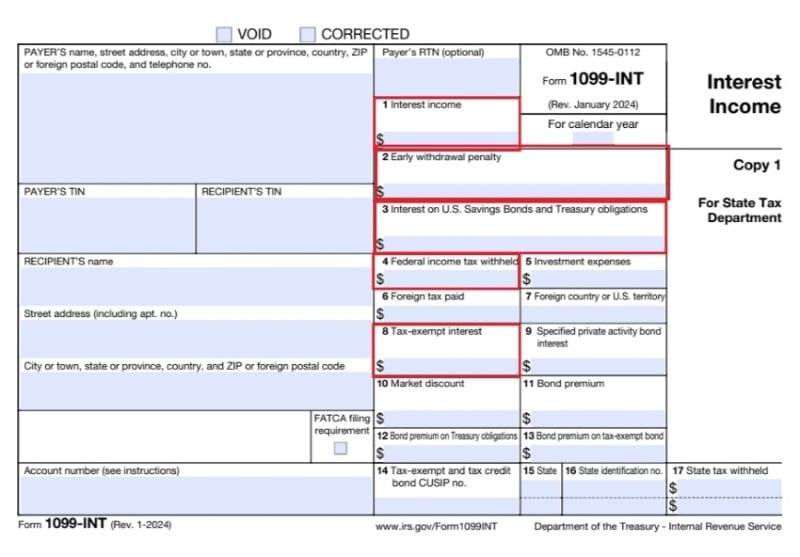

- Enter your information. That includes the payer's name, address, telephone number, and TIN. Please note that it asks not for your personal information but for the entity's. For example, use the name of the bank.

- Input the recipient's name, address, telephone number, and TIN.

- Fill Box 1 with the amount of taxable interest income.

- Report the amount of principal or interest forfeited because of the early withdrawal of funds in Box 2.

- Box 3 is for interest earned from the following: Treasury notes, bonds, and bills issued by the government and U.S. Savings Bonds.

- Box 4 is simply for the amount of taxes withheld from interest payments.

- Indicate the amount of tax-exempt interest on Box 8.

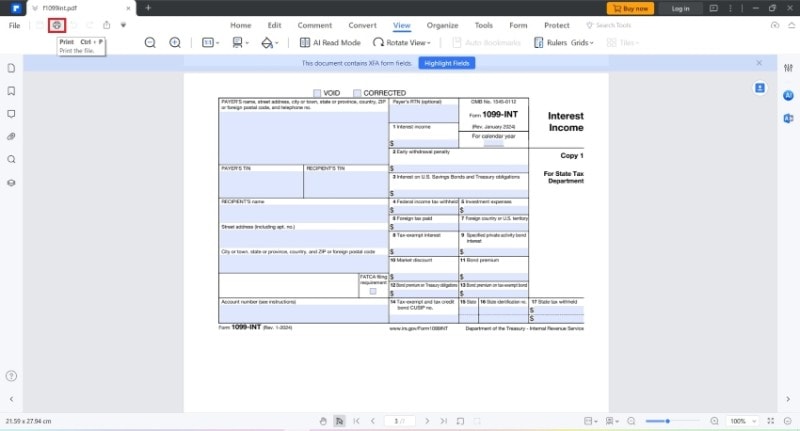

Part 4. How To View and Print 1099 INT Form Using Wondershare PDFelement?

Most of the time, the downloaded Form 1099 INT will be in PDF. And it is essential to review its contents to ensure the information is accurate. By doing so, you can request corrections from your bank if it does not match your records.

With that said, having a reliable PDF tool will be beneficial for you. Out of all your options, Wondershare PDFelement is the most impressive. First and foremost, it is easy to use and affordable. Thus, Wondershare PDFelement is accessible to more people.

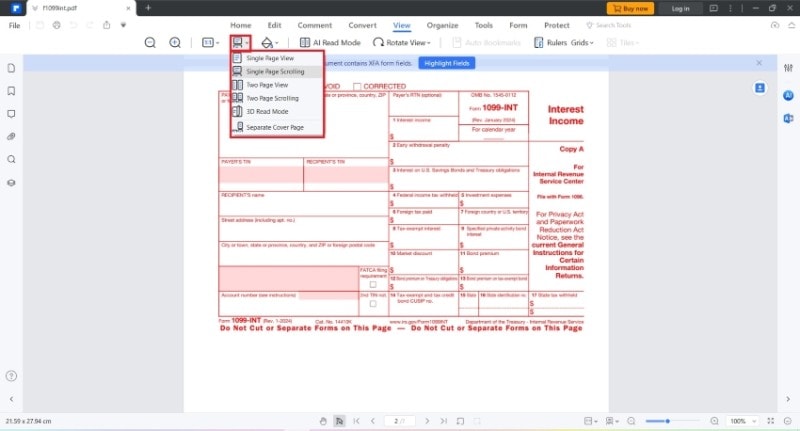

What makes Wondershare PDFelement excellent, especially for viewing Form 1099 INT? The answer is its View tab and its new printing feature: collated printing.

Under the View tab, you can find different layouts you can use to view your downloaded Form 1099 INT. You can make PDFelement display the full page on your screen, or you can have a zoomed-in view with the Full-width option. As for printing, Wondershare PDFelement's collated printing facilitates printing multiple copies of the Form 1099 INT.

In this section, you will learn how to use both PDFelement features.

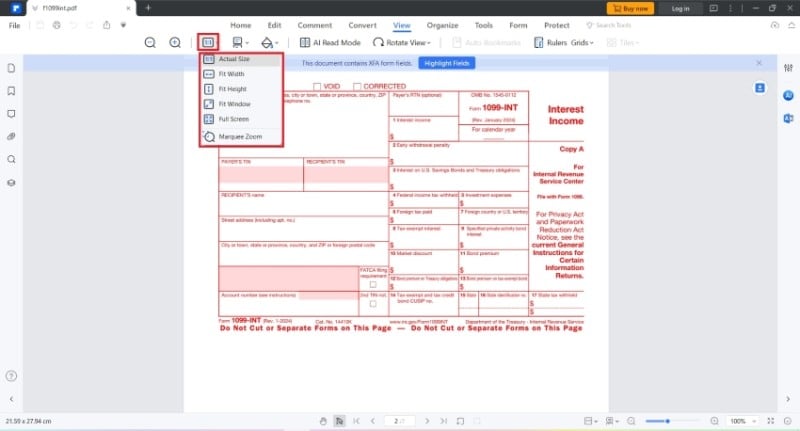

Part 4.1. View IRS Form 1099 INT Using Wondershare PDFelement

- Open Wondershare PDFelement and click Open PDF > select your Form 1099 INT. Alternatively, drag and drop the file into PDFelement's user interface.

- Click View.

- Click the first button after Zoom In. Select your preferred Page Size for reading the PDF.

- Optionally, click the Page View button. Select how you want to view the 1099 INT PDF. You can make only a single page shown on the screen or two at a time.

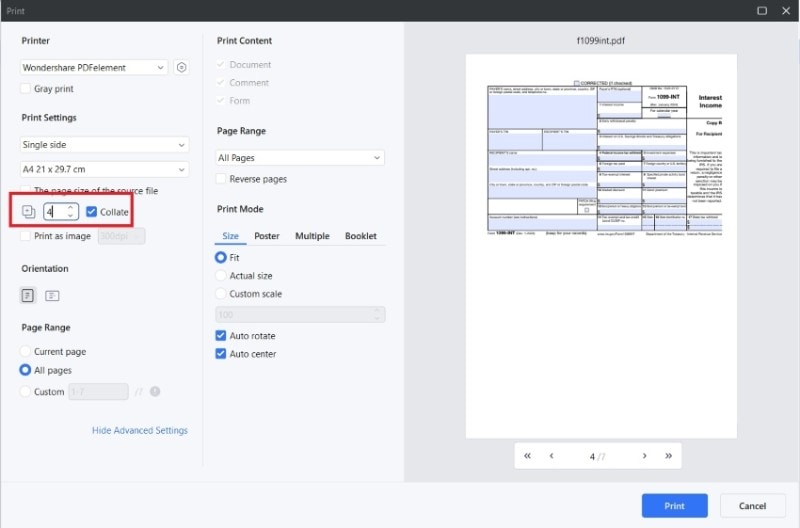

Part 4.2. Print Multiple Copies of the 1099 INT Form Using Wondershare PDFelement

Wondershare PDFelement's new printing feature is the Collated Printing feature. Instead of printing the PDF's first page multiple times before printing the next page, it prints each page once before creating duplicates.This makes it easier for you as you no longer rearrange the pages.

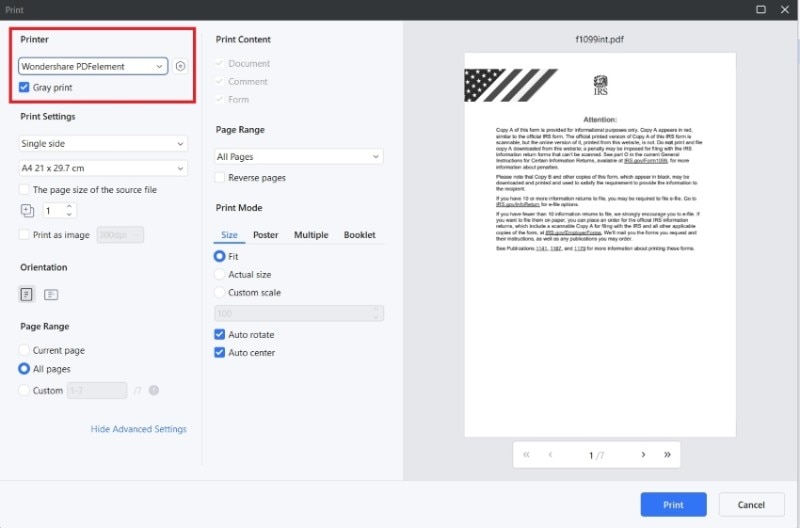

- Open your Form 1099 INT using Wondershare PDFelement.

- Click the Print button on the top right.

- Select a printer and check off Gray print.

- Specify how many copies you want to print. The Collate option will appear. Check it.

- Click Print.

Conclusion

A Form 1099 INT is a document that banks send to people who have earned at least $10 in interest in the tax year. If you qualify, they will send you one, usually on January 31st. Thus, you can expect to receive it in February. If you want to instantly get yours, you can download the one on your online banking account instead.

The downloaded Form 1099 INT will be a PDF, so you need a PDF reader. You have many options, but Wondershare PDFelement is the best one. It offers different views and collated printing. Both of these features are useful for Form 1099 INT reviewing and tax return record keeping.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure