How to Add Sales Tax to an Invoice in QuickBooks

2025-12-22 15:06:17 • Filed to: Quickbooks Tips and Tricks • Proven solutions

By default, QuickBooks creates a sales tax payable account when you set up your company account from the beginning. So when you want to enter your tax sales, you only need to enable the account and enter your sales tax. Below are all the instructions you will need to allow your sales tax and much more on QuickBooks.

How to Set up Sales Tax

- Enter your QuickBooks, select the edit menu and then click on preference.

- From the preference window, select sales tax.

- Then click on the company preferences tab.

- Click on the yes radio button to confirm that you collect sales tax.

- Then click on the “add sales tax item” and then enter the tax rate into the field for your state.

- To select your states’ revenue click on the tax agency from the drop-down list and then click ok.

- To add a sales tax for a particular city, click on the “add sales tax item” again and enter the required information.

- Then go ahead and select taxable item code and choose the appropriate option from the drop down to show that an item is taxable. The check the box to display the taxable amount.

- Then click on the option to collect taxes. If you charge for your products using invoice, then use the invoice date; otherwise the cash basis option is the option to click.

- Click on Ok.

How to Group Sales Tax

- Click on the List tab and select items. However, if your state charges separate sales tax from your city, then click on the item and choose new from the drop-down menu.

- Then proceed to select the sales tax group from the drop down and enter the required information.

- Click on the tax item and choose a specified sales tax for your city. Then click on the tab key.

- Click on OK.

How to Enter Sales Tax from Sales

- Click on customers and select sales receipts.

- Click on the fields that apply to your input all the required information.

- Select a template from the template drop-down list.

- Enter all essential sales information then click on the tax menu to choose the sales tax item/ sales tax group.

- Click on save and then close.

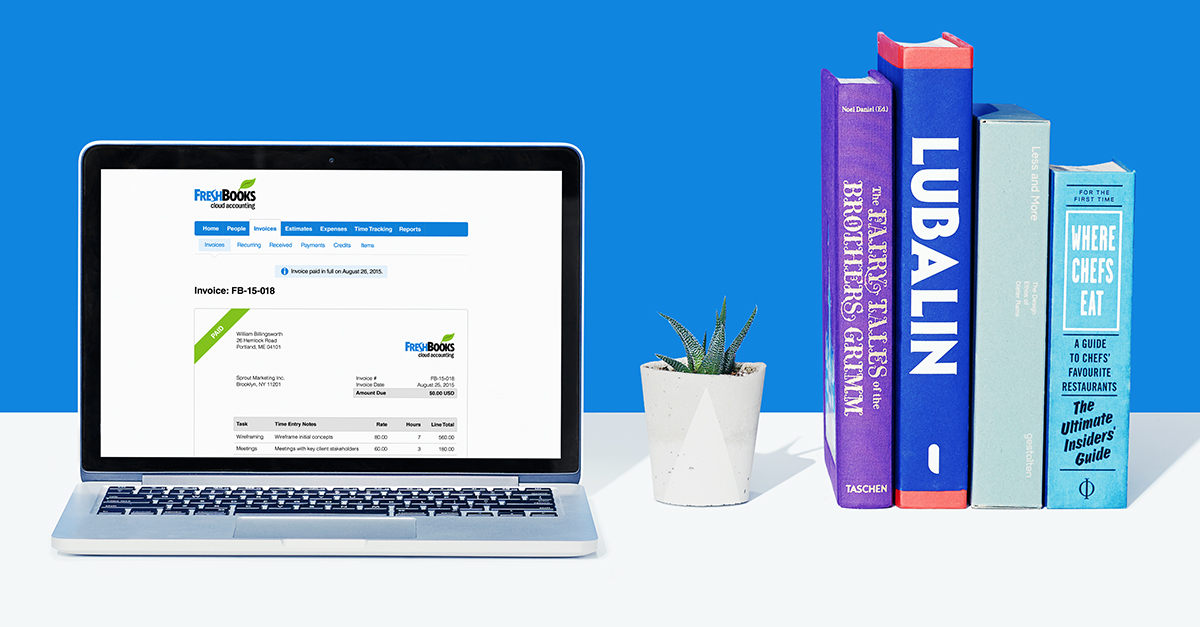

Best Alternatives to QuickBooks: FreshBooks

The account software market has been flooded with variety making it challenging to find the best alternative to the QuickBooks services at an affordable price. FreshBooks created 2004 specially targeted at small business and freelancer offers the best services at an affordable price. It is equipped with features that are sure to make your task simple and fast.

Try Freshbooks for Free >>>

FreshBooks allows you to organize your expenses effortlessly, Track your time, and impress your clients with a smooth and professional invoice and many more. All these features are yours at an affordable rate, and you have nothing to worry about.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Up to 18% OFF: Choose the right plan for you and your team.

PDFelement for Individuals

Edit, print, convert, eSign, and protect PDFs on Windows PC or Mac.

PDFelement for Team

Give you the flexibility to provision, track and manage licensing across groups and teams.

Elise Williams

chief Editor

Generally rated4.5(105participated)