How to Reconcile Accounts in QuickBooks

2026-02-05 16:24:33 • Filed to: Quickbooks Tips and Tricks • Proven solutions

There are many benefits to reconciling your account regularly whether your business is small or a big one. For one thing, it allows you to resolve any discrepancies between the bank and the record you have. Also, it is the perfect way to ensure that your financial statement is up-to-date.

How to Reconcile Your Accounts in QuickBooks

Before you start the reconciliation process, make sure you have your credit card/ bank statement for the account(s) you want to reconcile. As you would need it throughout the whole process; after all, it is called reconciliation.

- Go to the homepage and select the gear icon that is on the left of your company name. Under the column labelled tools, click on reconcile.

-

The click on the credit card/ bank account you wish to reconcile and fill out all the necessary fields. Usually, it is something like this;

i. Click on the account and select credit card/bank account you want to reconcile from the drop down.

ii. Then the beginning balance field will appear and is usually already populated with the ending balance from last month’s statement. Sometimes, the beginning balance won’t appear, don’t worry, a link to resolve the issue will appear. Click on it and input the required information before proceeding with the reconciliation at hand.

iii. The next field is for the ending balance, and here you will input the balance on your current bank statement.

iv. Then on the next field labelled end date, you will enter the end date on the bank statement too.

v. Then you click on start reconciling to continue to the next step. -

Once you clicked on start reconciliation, you will be taken to another screen where you have to enter the necessary information. Below is the information contained on the page:

a. Statement's ending balance which is the same as the one on your account statement.

b. Beginning balance which is the same as the ending balance from the previous month. This field is auto-filled by QuickBooks.

c. Cleared balance which will change as you continue reconciling your accounts.

d. Payments which will increase as you continue reconciling your accounts.

e. Deposits.

f. Difference: usually calculated by QuickBooks.

g. Transactions. - Once all your transactions have matched that of your bank statement, click on the finish now button to confirm $0.0 difference. You also generate a reconciliation report here.

- Once you have done all your reconciliation, always remember to review it then click on save.

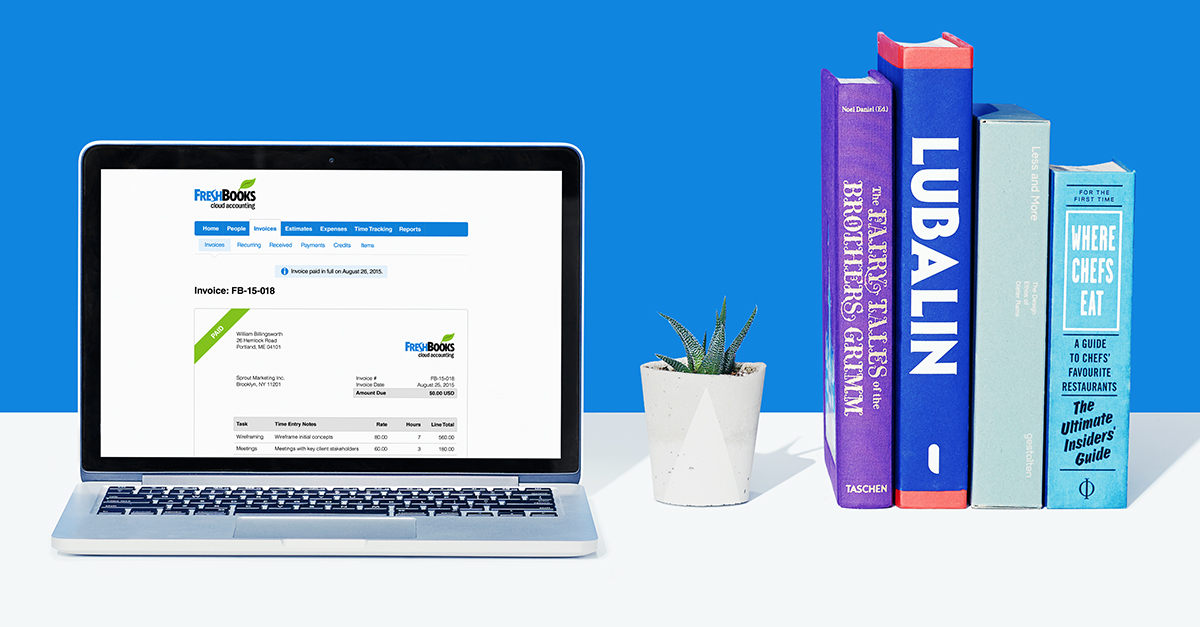

Best Alternatives to the QuickBooks: FreshBooks

FreshBooks is the best alternative to the QuickBooks services you can find in the marketplace. It is very suitable for entrepreneurs and small businesses as it is affordable. It is easy to set up, use and works well with different time/expense tracker. It enables you to make reconciliations on your accounts effortlessly and fast.

FreshBooks one of the best alternative to obtaining the top-notch services provided by QuickBooks. It is easy to use accounting software created with the aim to help small businesses grow and become better. They provide the best services to you at a lower price, giving you the chance to make all the necessary decisions without any compromise.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Up to 18% OFF: Choose the right plan for you and your team.

PDFelement for Individuals

Edit, print, convert, eSign, and protect PDFs on Windows PC or Mac.

PDFelement for Team

Give you the flexibility to provision, track and manage licensing across groups and teams.

Elise Williams

chief Editor

Generally rated4.5(105participated)