Top 5 Small Business Tax Software Programs

2026-02-02 10:23:12 • Filed to: Software for Business • Proven solutions

Taxes are a necessary evil for any business. They are also important, so you must be very careful since a small mistake could lead to an audit, which is something best avoided. This is why most people turn to small business tax software that can act as a guide to help fill in your tax forms correctly. The main problem is that there are so many free small business tax software solutions on the market that it is becoming increasingly difficult to pick the right one for your needs.

In this article, we'll highlight 5 of the best small business tax software programs of 2018.

Part 1: Top 5 Small Business Tax Software

1. H&R Block

H&R Block tax software offers a unique way of preparing taxes that guides you through every step of the way with the right deductions and credit that apply to you. It comes with drag and drop features and import capabilities to access the previous year’s tax return information. It includes free federal e-files, in-person free audit support, and detailed guidance with checkpoints to ensure you’re doing it right. This tool also offers unique support and security features, ranging from data security, tax identity care protection, plus chat and phone technical support. It has a great user interface and a free version for small business tax software, considered one of the best on the market.

Pros

- Easy to install

- Issues are corrected quickly

- Process is fast and easy

- Refund maximized

- Clear instructions

- Easy to use

- Simple importing abilities

Cons

- Some issues are difficult to fix

- Time consuming

2. TurboTax

For three decades TurboTax has been rated as the top tax software for helping North Americans file their taxes correctly. This software is continually updated to meet the requirements of new tax laws. It performs error checks to guarantee accuracy and provides a highly intuitive user interface. The newest features include the ability to request an experienced EA and CPA professional to review your tax returns. It also has a mobile app, which ensures your taxes are done right through seamless syncing between your computer, tablet and Smartphone. The SmartLook feature allows you to connect with a specialist by video for extra guidance and answers to your questions.

Pros

- Easy to use

- Free tax filing options

- Includes intuitive tools

- Easy to add, update or backtrack returns

- Supports state returns

- Includes expert help for complicated returns

Cons

- State return filing can be expensive

- Includes upselling prompts on many sections

3. Freetaxusa

With Freetaxusa, filing federal returns costs nothing, no matter what your income or filing status is. State returns are inexpensive to file through the software, while federal returns for small businesses can be done for free. The small business tax preparation software only offers a cloud-based online software. It is straightforward to use, with zero over-the-top color palettes, embedded content or distracting animations. The program allows for uploading of PDF tax returns from TaxAct, H&R Block, and TurboTax. Pop-up messages throughout the process help you complete your taxes correctly, and a banner tracker ensures that all the necessary steps have been completed.

Pros

- Inexpensive tax software

- Straightforward and easy to use

- Free filing for federal returns

- Popup help and completion trackers

- Email support

- Easy upgrade to Deluxe from free version

Cons

- You must pay to file State returns

- Plain interface

4. ProConnect

This web-based tax software is accessible via mobile devices, Mac, and Windows. ProConnect offers straightforward navigation and an easy data entry process for tax filing. You can easily search for each element of the tax return, including line numbers, amounts, or names. This tool also supports more than 5,600 forms, and has e-filing support for state and federal forms. ProConnect integrates with QuickBooks so you can import many documents from Excel, as well as Schedule D, K-1 and W-2 data. ProConnect offers training tools from videos to online webinars, all accessible online.

Pros

- Straightforward software

- Price dependent on the type of form you are filing

- Great help and support options

- Free conversion feature for new users

- QuickBooks integrated

- Multiple document import capability

Cons

- Lacks line by line filing instructions for forms

- Can be expensive depending on forms being processed

5. TaxAct

TaxAct is excellent for contractors, freelancers, and the self-employed, particularly the Freelancer edition. TaxAct Business is superb for S-Corporations, C-Corporations and Partnership LLCs. This tax tool offers a clear process and instructions, with guides to help users make the most out of every deduction. TaxAct only allows for filing of a single federal tax return, meaning it costs much less than other tax software such as H&R Block and TurboTax. For every state tax return that needs to be prepared and filed, you will be charged an additional cost. While other tools allow for multiple tax returns, TaxAct limits users to a single tax return.

Pros

- Great user interface

- Quality navigation tools

- Chat and phone support available

- In-depth review process

- Efficient for mobile use

- Great pricing

Cons

- State filing can be expensive

- Multiple tax returns is not supported

- No audit support

Part 2: Introducing PDFelement – Work Better with Small Business Tax Software

Running a small business involves dealing with reports, receipts, quotes, tax returns and many other files containing critical data for tax filing and financial management. However, most software doesn't easily convert all this data into a usable format. But with PDFelement, working with tax accounting software is made much easier for your small business. You can produce editable, fillable and password protected files. PDFelement comes with many advanced functionalities such as data extraction, password protection, fillable form creation, conversion to and from different file types, and redaction. PDFelement also has form field recognition features.

5 Solutions PDFelement Offers to Cover the Features Lacking in Small Business Tax Software

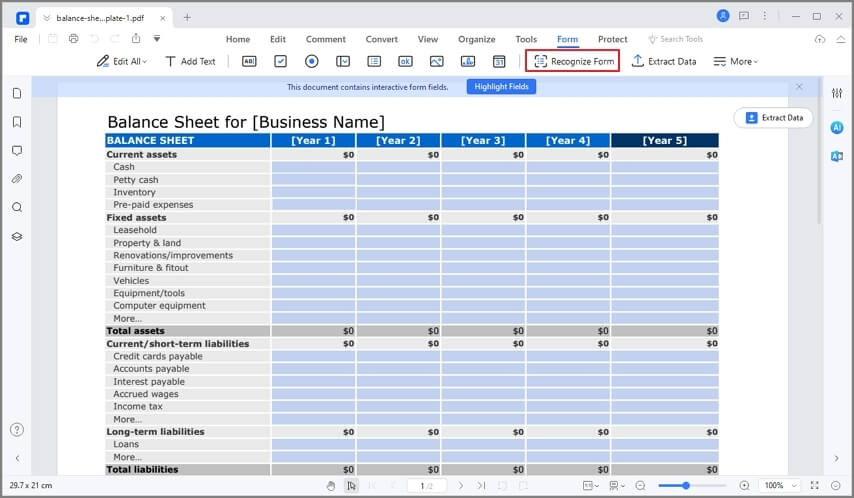

1. Form field recognition and fillable forms

While preparing taxes for small business, you’ll find many forms that need to be filled and processed. It’s time consuming, especially if your tax tools lack these functionalities. PDFelement offers unique automatic form field recognition features on editable, fillable and usable PDFs. In the process you’ll save many hours that would have been spent on manually printing, sending and filling out tax forms.

2. Combine tax forms and other attachments into one PDF

During tax season, you'll have to gather many important attachments and make sure they are in a standard format that can be easily used and submitted. Combining tax forms into a single PDF is often useful, even if your tax software doesn’t support this functionality. Not to worry though; PDFelement can help. Easily transform all your materials into one PDF that’s intuitive, editable and can be used as desired.

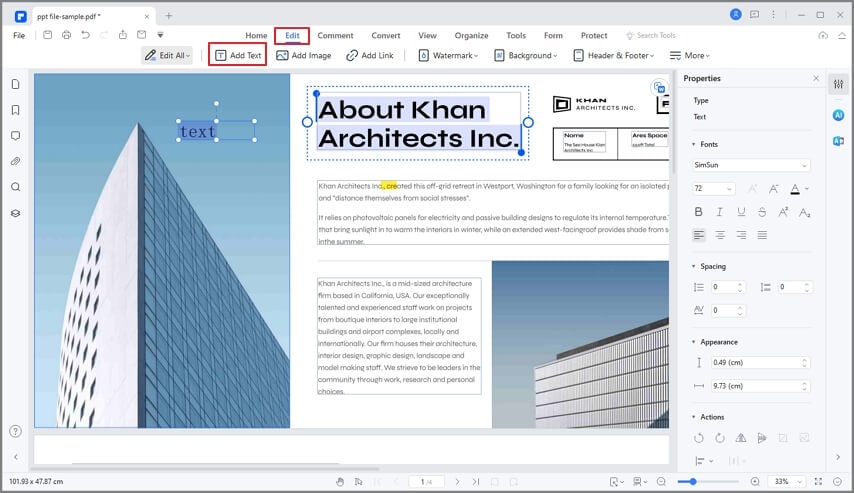

3. Easily edit PDF tax form

Paper tax forms won't work when it comes to tax software. You'll need to convert these tax forms into editable PDFs. However, a digital PDF tax form that is not editable is no better than paper. You'll waste trying to edit, convert, or manually extract data from these files. However, PDFelement works with your tax software by providing OCR (Optical Character Recognition) allowing you to easily transform your files and documents into editable PDF forms from many different formats. OCR detects characters on your scanned tax forms and quickly converts them into files you can edit and search.

4. Extract data

No accountant or business owner wants to face the burden of manually extracting and exporting thousands of files worth of data. PDFelement helps you save time by offering a simple, easy and quick data extraction and export functionality that can be done in just a simple click. All extracted data comes ready for analysis, and can be used instantly.

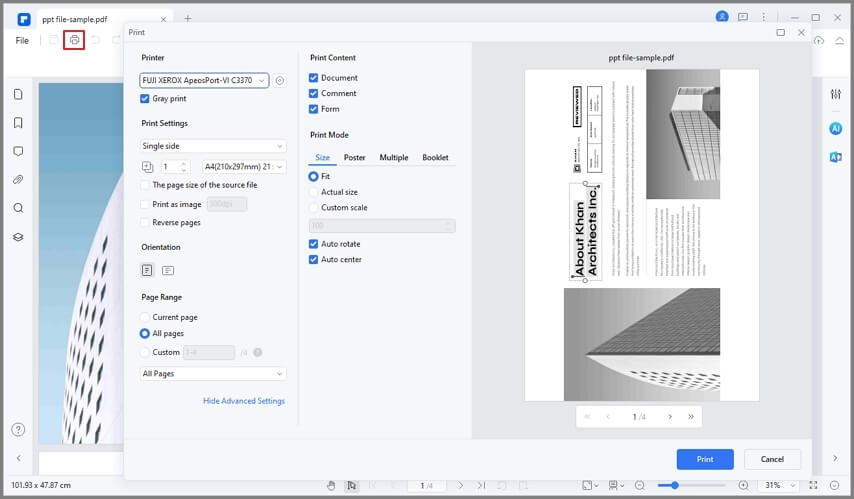

5. Print PDF

Even when using tax software, you may need to print a paper copy of your tax return for your records or to share with other authorities. Not all tax software supports printing to PDF, and even if it does, the quality is often compromised, and it does not meet industry standard PDF file format. PDFelement allows you to extract and convert all your files into a format adhering to ISO standard PDF and PDF/A requirements. In addition, the advanced OCR functionality ensures that the PDF is editable and searchable once saved in your online records.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Up to 18% OFF: Choose the right plan for you and your team.

PDFelement for Individuals

Edit, print, convert, eSign, and protect PDFs on Windows PC or Mac.

PDFelement for Team

Give you the flexibility to provision, track and manage licensing across groups and teams.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Elise Williams

chief Editor

Generally rated4.5(105participated)