Everyone loves to receive a tax refund! Essentially, if you overpaid on your tax liability, you will be eligible to apply for a refund on the excess amount. Over the past two years, tax refund schedules - IRS payout schedules - have been affected by COVID-19, since they're directly linked to the extensions given by the government in times of crisis.

So far, the tax return schedule for 2022 appears to be following regularized timelines, with a few exceptions in states that have recently experienced a natural disaster. Let's take a look at key dates and deadlines for this year's IRS refund schedule. It's important to stick to every single deadline if you want to avoid hefty penalties and interest on unpaid amounts.

Part 1: People Always Ask (FAQs)

Q1: When can I expect my tax refund in 2022?

Depending on the IRS tax return acceptance date, your 2022 tax refund for the 2021 tax return filing should hit your bank account between a week and three weeks later. Of course, these are merely guidelines and are not IRS-guaranteed; however, that's the typical timeline after the tax return acceptance date for that year has passed.

Q2: How long does it take to get your tax refund direct deposit 2022?

Normally, it takes between 7 and 21 days after the tax return acceptance date to receive your tax refund from the IRS. Assuming you've filed your return on time, you can check the status of your tax refund on the IRS.gov website.

Part 2: Key Dates for IRS Tax Refund

January 2022 Tax Key Dates

Date |

Deadline for… |

| Jan 3 | 50% of 2020 deferred social security tax to be paid by self-employed individuals |

| Jan 10 | Employees to report tips for Dec 2021 to their employers [Form 4070] |

| Jan 18 | Paying estimated tax for Q4-21 [Form 1040-ES] Farmers and Fisherman to pay estimated tax for 2021 [Form 1040-ES] |

| Jan 24 | Start date for acceptance and processing of 2021 tax returns [Form 1040] |

| Jan 31 | Filing Form 1040 [2021 tax return] in case the Jan 18 deadline for paying final estimated tax installment is not met |

The January dates and deadlines primarily cover the acceptance and processing start dates for the IRS. They also cover the date to pay half the 2020 social security taxes that were deferred from the previous tax year, 2020, and reporting of monthly tips for December 2021. Finally, there are three important dates for estimated tax payments: Q4-2021 estimated payments, FY-2021 payments for farmers and fishermen, and the final date to file your 2021 tax return in case you haven't paid the estimated tax amount by the Jan 18 deadline.

February 2022 Tax Key Dates

Date |

Deadline for… |

| Feb 10 | Employees to report tips for Jan 2022 to their employers [Form 4070] |

| Feb 15 | Reclaiming exemption from withholding (2022) [Form W-4] Extended deadline for Hurricane Ida victims in Connecticut, Pennsylvania, New York, Louisiana, New Jersey, and Mississippi to file and pay for the period Jan 1 through Feb 14 |

| Feb 28 | Extended deadline for Alabama storm and flooding victims to file and pay for the period Jan 1 through Feb 27 |

Feb 10 is the deadline to report January 2022 tips to employers. If you want to reclaim exemption from withholding for the ongoing tax year, the deadline to file Form W-4 is on Feb 15, assuming you were exempt in the current tax year and you are still eligible for exemption.

Feb 15 is also the extended deadline for victims of Hurricane Ida to fulfill their filing and payment obligations from Jan 1 through Feb 14. Finally, flooding and storm victims in Alabama have until Feb 28 to fulfill similar obligations for Jan 1 through Feb 27.

March 2022 Tax Key Dates

Date |

Deadline for… |

| March 1 | Farmers and Fisherman to file Form 1040 (2021 tax return) if estimated tax hasn't been paid as of Jan 18 |

| March 10 | Employees to report tips for Feb 2022 to their employers [Form 4070] |

| March 15 | Extended deadline for Washington flooding and mudslide victims to file and pay for the period Jan 1 through March 14 |

On March 1, farmers and fishermen have a deadline for filing their 2021 tax returns, assuming they haven't paid their estimated tax by Jan 18. Employees must report their Feb 2021 tips to their employers by March 10. For flooding and mudslide victims in Washington, the deadline to fulfill all filing and payment obligations through March 14 is March 15.

April 2022 Tax Key Dates

Date |

Deadline for… |

| April 1 | Taking the RMD (required minimum distribution) from your 401(k) and IRA if you turned 72 in 2021 |

| April 11 | Employees to report tips for March 2022 to their employers [Form 4070] |

| April 18 | File 2021 tax return [Form 1040] and pay the tax due, except if residing in Maine or Massachusetts Request six-month tax return filing extension (tax payment not extended) [Form 4868] Household employees to file Schedule H (1040) and pay employment taxes if Form 1040 not filed Withdraw excess IRA contribution for 2021 and avoid a penalty if Form 1040 filing was not extended Contribute to IRA for 2021 Contribute to HSA for 2021 Contribute to SEP or Solo 401(k) plan (self-employed) if Form 1040 filing was not extended |

| April 19 | Maine and Massachusetts residents to file Form 1040 for 2021 and pay the tax due |

April, of course, is a crucial month for tax return deadlines. The most important date is April 18, which is the last day to file your 2021 tax return. You can also file a Form 4868 by April 18 to get a six-month extension on the filing date, but this does not defer your tax payments. For employers of houseworkers, nannies, etc., the deadline to file Schedule H and pay employment taxes is also April 18. Residents of Massachusetts and Maine have until April 19 to comply with the filing requirements since April 18 is Patriot's Day.

If you turned 72 last year, April 1 is the deadline to take the minimum required distribution from your 401(k) and IRAs. On April 11, employees who received tips exceeding $20 must report their March 2021 tips to their employers. Filers can also contribute to their IRAs, Solo 401(k), and Health Savings Account for the 2021 tax year by April 18.

Other 2022 Tax Key Dates

We've covered all key tax return 2021 dates through the end of April, but what about the rest of the year? It's best to be prepared for Tax Year 2022 well ahead of time so you're not blindsided by penalties and other charges. Here's a look at the October 2022 tax return schedule and the deadlines you should be aware of:

Date |

Deadline for… |

| Oct 17 | Filing extended 2021 tax return and paying the tax due Contribute to SEP or Solo 401(k) plan (self-employed) if Form 1040 filing was extended Withdraw excess IRA contributions to avoid a penalty if Form 1040 filing was extended |

And that's a wrap on our comprehensive list of important dates and deadlines for the tax year 2021. Check your IRS tax refund schedule to see when you can expect the direct deposit on what you're owed back, and make sure you don't miss any deadlines in the tax return schedule for 2022.

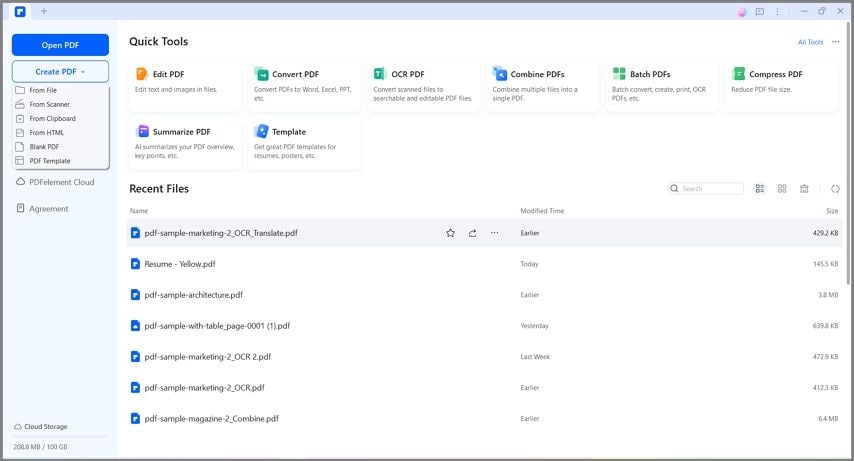

Part 3: How to Fill Out Tax Forms with PDFelement for Windows

If you're doing your own tax filing, you'll need access to a robust PDF editor that you can use to fill out the numerous forms that are required each year. PDFelement for Windows offers a user-friendly way to fill out your tax forms, sign them, and save them for electronic distribution or as printouts. Let's look at the steps involved in filling out a tax form:

Wondershare PDFelement Pro DC

Simplify your Workflow with the PDFelement Cloud.

Step 1 Import the PDF form and Use Form Field Highlighting

Open the form in PDFelement using a drag-and-drop action or using the Open Files icon on the home page

If the form is interactive, you will see them highlighted in a different color from the other content in the file.

Step 2 Fill out the Form

Click each form field and input the required data.

For non-interactive forms, click on Form → More → Recognize Form. This will identify and highlight all fillable form fields.

You can now toggle to Form Edit mode to go into editing mode, after which the filed inputs can be typed in or pasted from elsewhere.

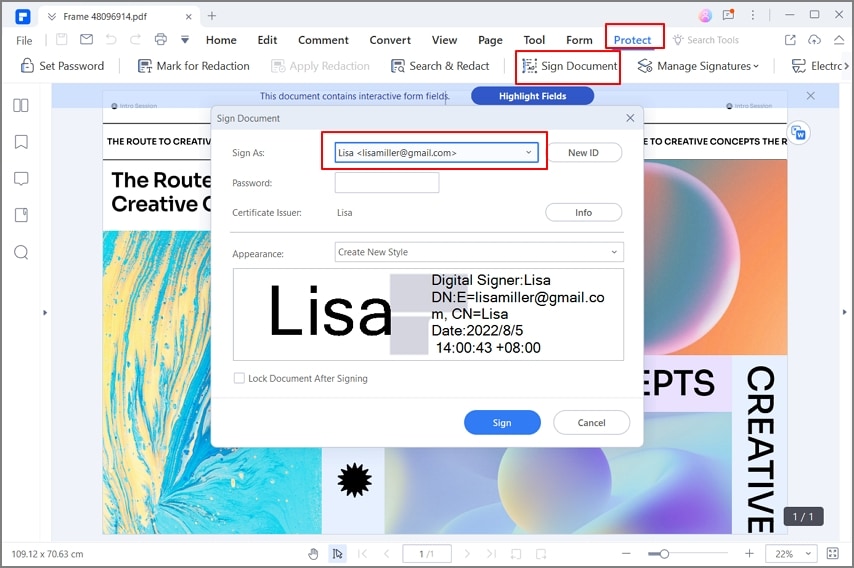

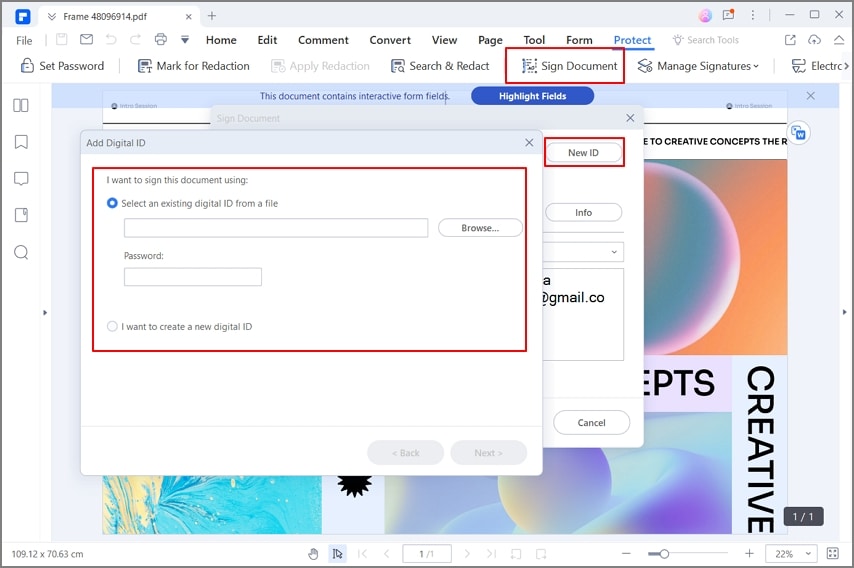

Step 3 Add a Digital Signature

Click the Protect tab at the top and then click Sign Document in the toolbar below it.

If you already have a digital signature stored, you'll see it in the Sign As dropdown. If not, you can either import an existing one or create a new ID.

Once the digital signature is created, you can preview it and hit the Sign button to apply it to the document. You can move it around and resize it to fit the corresponding space provided.

Parting Thoughts

A full-fledged PDF editor such as PDFelement is required for this process because most PDF readers may allow you to fill and sign forms, but only with an electronic signature rather than a verifiable digital signature. Moreover, PDFelement is the most user-friendly and affordable product in this category, which makes it the perfect choice for all your tax return and tax refund requirements in 2022!

Home

Home

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure