Data Extraction from Invoices: How to Capture Invoice Data Without Manual Entry

Paper invoices take time, create mistakes, and slow essential financial processes. Companies that handle increasing volumes find it difficult to get the right invoice information at all times. Manual entry is inefficient, expensive, and hard to manage as the operations increase in scale. Modern automation now enables data extraction from invoices without repetitive typing. Instead, systems capture key fields directly from documents using intelligent recognition technologies.

This approach improves accuracy, speeds processing, and allows finance teams to focus strategically. Ultimately, automated invoice processing supports scalability, compliance, and better decision-making. Adoption reduces costs while strengthening control across complex modern accounting environments.

In this article

- What is Data Extraction From Invoices?

- Why Manual Invoice Data Entry No Longer Works

- What Data Needs to Be Extracted From an Invoice?

- How Invoice Data Extraction Works: From Scan to Structured Data

- Invoice Scanning and Data Capture: Common Challenges

- What to Look For in Invoice Data Extraction Software

- Using PDFelement to Extract and Capture Invoice Data

- From Invoice Data Capture to Expense Tracking and Tax Filing

- Common Mistakes in Invoice Data Extraction Workflows

Part 1. What is Data Extraction From Invoices?

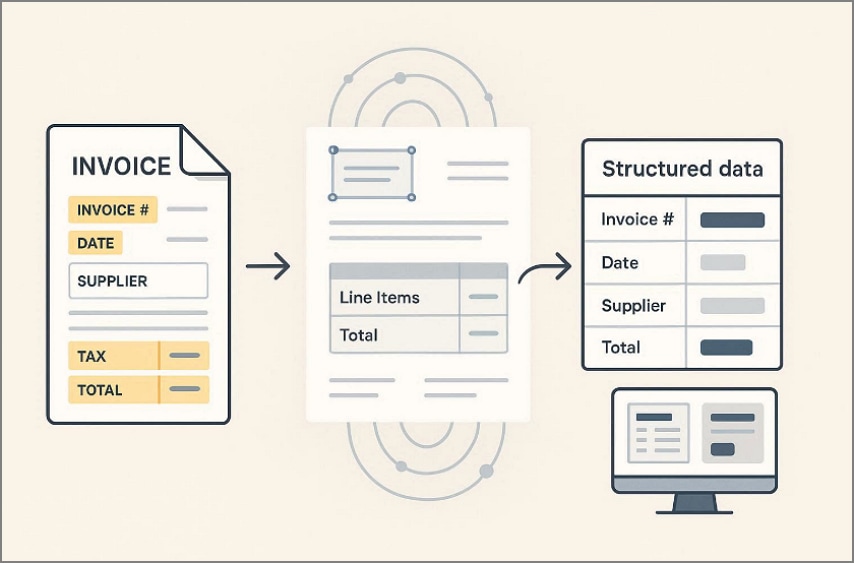

Invoice data extraction is the process of automatically extracting key invoice information from computerized or scanned documents. Systems will be able to recognize and process invoice data, including invoice numbers, dates, supplier names, line items, taxes, and totals, without manual entry. This extracted data is later processed and converted into structured formats that can be processed directly by accounting or finance systems.

At its core, invoice data extraction goes beyond simple text reading. While basic tools may recognize words on a page, advanced extraction focuses on understanding what each piece of information represents. This distinction is critical for accurate financial processing, reporting, and compliance across business operations.

OCR Text Recognition vs. Structured Invoice Data

| Aspect | OCR Text Recognition | Structured Invoice Data |

| Purpose | Reads text from scanned documents | Identifies specific invoice fields |

| Output Format | Unstructured text blocks | Organized data fields |

| Context Understanding | No understanding of meaning | Understands the roles of values |

| Automation Readiness | Limited | Fully system-ready |

| Accuracy for Accounting | Low without manual review | High when properly configured |

Why Invoice Data Extraction Matters

Handling invoice data properly saves teams from repetitive typing and constant manual corrections. When invoice details are accurate, approvals move more quickly, and cash flow becomes easier to follow. As more invoices come in, automation simply helps teams avoid confusion and stay on top of work.

Part 2. Why Manual Invoice Data Entry No Longer Works

As invoice volumes continue increasing, manual processes fail to meet modern operational requirements. Below are the key reasons why "data entry invoice" tasks and repeated data entry of invoices no longer work effectively:

Time Consumption: Manual data entry invoice processing consumes hours that automation completes within minutes. Repeated typing across invoices reduces productivity and delays downstream financial approvals processes.

Human Errors: Manual invoice entry increases the risk of data errors, including missing fields and incorrect calculations. Such issues often require rework and can delay payments or complicate reconciliation processes.

Limited Scalability: As invoice volumes grow, manual workflows struggle to scale efficiently for businesses. Hiring additional staff increases costs without solving speed or accuracy limitations issues.

Poor Visibility: Manual processes limit real-time visibility into invoice status and cash flow. Lack of transparency makes tracking approvals, exceptions, and bottlenecks significantly harder organization-wide.

Compliance Risks: Inconsistent data entry invoice practices increase audit risks and regulatory exposure. Missing documentation and errors complicate compliance reporting and internal control requirements.

Part 3. What Data Needs to Be Extracted From an Invoice?

To extract invoice data properly, systems must collect fields that support everyday finance tasks. These details help teams handle payments smoothly, prepare reports, and complete audit checks with fewer issues. When invoice data is organised correctly, it can be used in accounting systems without extra fixes.

Key Invoice Fields That Must Be Captured

Each field affects how invoices move through later finance processes within the organization. If values are missing or entered incorrectly, payments can fail and reports may not match.

| Invoice Field | What It Represents | Why It Matters |

| Merchant Name | The seller or service provider issuing the invoice | Enables supplier tracking and vendor reconciliation |

| Invoice Date | The date the invoice was issued | Supports payment terms and period-based reporting |

| Currency | The transaction currency used | Ensures correct conversions and financial consistency |

| Subtotal | Amount before taxes or additional charges | Provides a clear base cost reference |

| Tax Amount | Applied the tax value on the transaction | Required for tax reporting and compliance |

| Total Amount | Final payable amount including taxes | Drives payment accuracy and cash flow tracking |

Why Structured Invoice Data Is Essential

Well-organized invoice data helps finance and accounting teams reduce manual steps in daily workflows. When information is clear, systems can check totals, handle tax rules, and support reporting tasks. With higher invoice volumes, structured extraction helps maintain accuracy and visibility across operations.

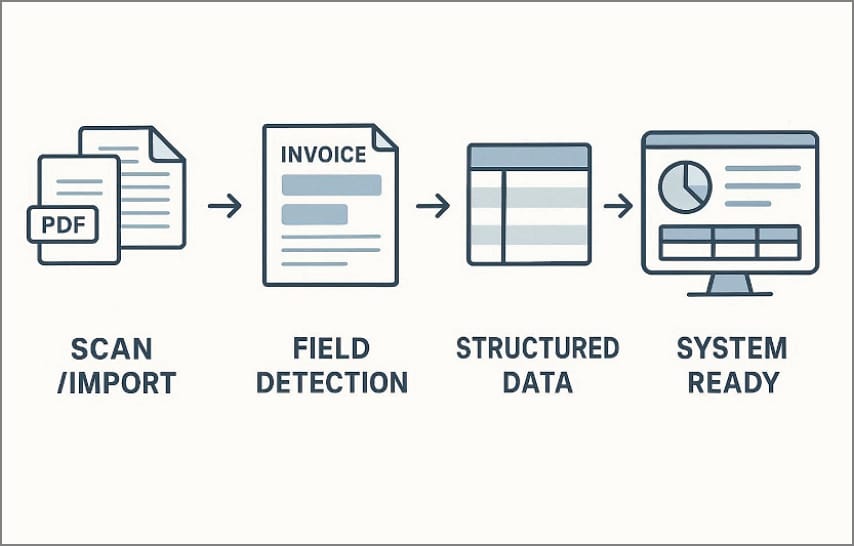

Part 4. How Invoice Data Extraction Works: From Scan to Structured Data

Invoice data extraction involves converting invoice documents into structured information. This allows invoices with different layouts to be handled consistently by systems. This process enables "extracting structured data from invoices" without manual intervention.

Scanning or Importing Invoice Documents

The process usually starts when invoices are scanned or uploaded as digital files. These files often come from emails, shared folders, or existing accounting systems. Once imported, the invoice becomes the input source for automated processing.

Identifying Invoice Fields Across Different Layouts

Invoices often look very different, with changes in layout, language, and overall formatting. Extraction tools look at how each document is laid out to find details like names, dates, and totals. Rather than using fixed templates, these tools rely on context and position to locate information.

Converting Unstructured Invoices Into Structured Data

Once the key details are found, the information is placed into an organized format. Each value is checked to make sure it looks right and matches the rest. After that, the data can be sent into accounting or reporting systems without extra handling.

Part 5. Invoice Scanning and Data Capture: Common Challenges

Invoice scanning and data capture present several practical challenges during real-world processing. These issues often limit accuracy, scalability, and reliability across finance workflows.

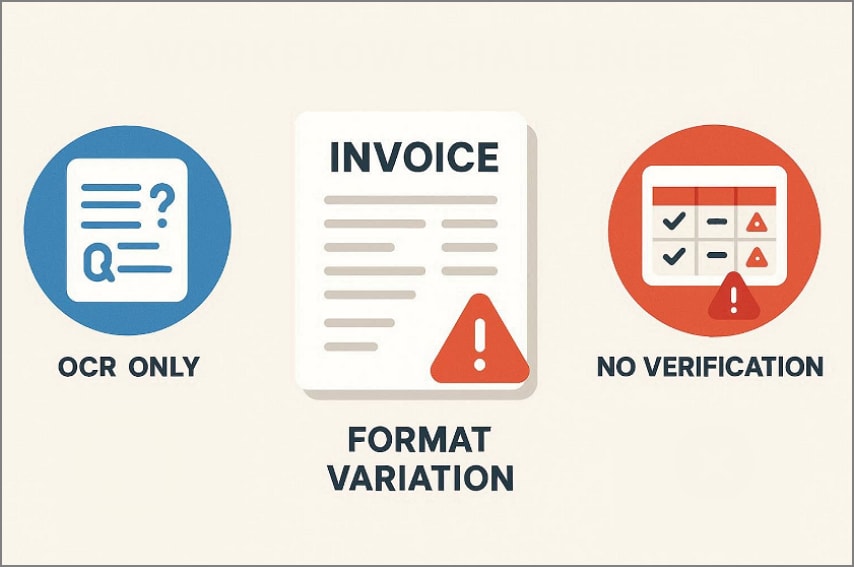

Limitations of OCR-Only Invoice Scanning

OCR-only scanning focuses on reading text but lacks contextual understanding. While it can convert images into readable characters, it cannot reliably determine which values represent totals, taxes, or dates. As a result, extracted data often requires manual review before use.

Variations In Invoice Formats And Layouts

Invoices arrive in countless designs, languages, and structures depending on the suppliers. Fixed-template systems struggle when layouts change or fields appear in unexpected positions. These variations reduce consistency and increase exception handling during processing.

Accuracy Issues Without Data Verification

Without validation rules, extracted values may include missing fields or incorrect amounts. Errors can remain unnoticed until payment runs, reconciliations, or audit checks take place. Verification helps ensure extracted information matches required accounting and compliance standards.

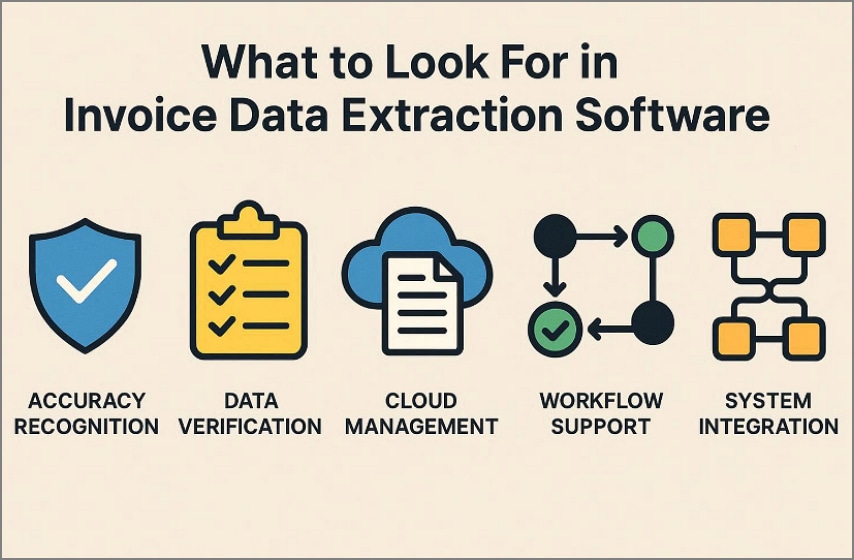

Part 6. What to Look For in Invoice Data Extraction Software

Different tools promise automation, but results vary once real invoices enter the system. The following features highlight what separates dependable invoice data capture software from simple OCR tools:

Accuracy Recognition: High accuracy ensures invoice fields are identified correctly across varied document formats. Reliable recognition reduces manual corrections and improves trust in extracted financial data.

Data Verification: Built-in validation checks confirm totals, taxes, and dates before downstream processing. Verification rules prevent costly errors and support compliance requirements during audit reviews.

Cloud Management: Cloud storage centralizes invoices securely and supports controlled access for teams globally. Document management features enable version tracking, retention policies, and faster retrieval processes.

Workflow Support: Integrated workflows support reimbursements, approvals, and tax reporting without manual intervention steps. Automation aligns finance operations with regulatory requirements and internal approval structures consistently.

System Integration: Seamless integrations connect extracted data with accounting ERP and payment platform systems. Integration capability maximizes value from invoice data capture software investments across organizations.

Part 7. Using PDFelement to Extract and Capture Invoice Data

As invoice volumes increase, finance teams often juggle scattered receipts, delays, and repetitive manual checks. Invoices arrive from multiple sources and sit across inboxes and folders, requiring constant device switching. Over time, fragmented handling slows processing, increases errors, and complicates tracking during audits.

So, tools like PDFelement fit here by supporting existing workflows rather than replacing human review. The software accelerates scanning, captures essential invoice fields automatically, and simplifies verification steps. This approach reduces repetitive effort while preserving accuracy, visibility, and control across invoice processes.

Guide to Extract and Capture Invoice Data with PDFelement

Let's dive into the step-by-step guide below to extract and capture invoice data using PDFelement:

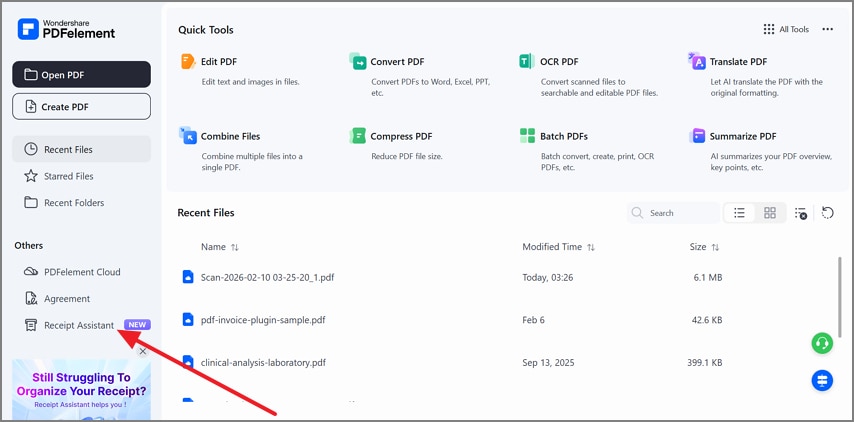

Step 1Access Receipt Assistant to Proceed

To begin, launch PDFelement and go to the left sidebar on the home screen to choose the "Receipt Assistant" feature.

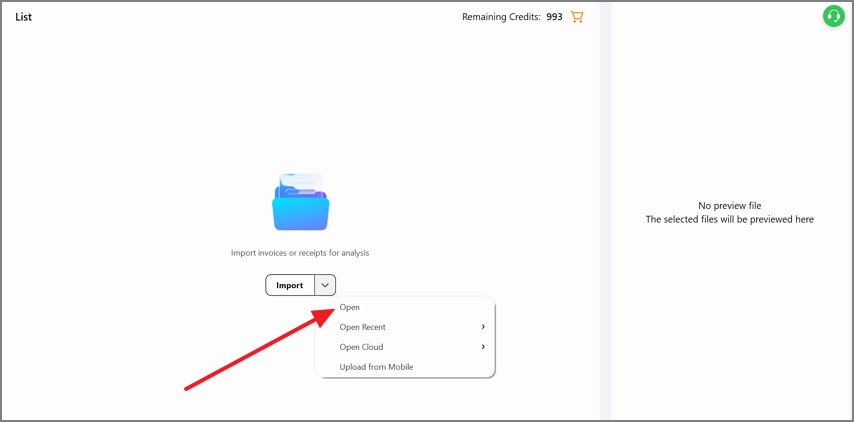

Step 2Import Invoice or Receipt Files

Next, in Receipt Assistant, click "Import," then select "Open" to add invoices and continue.

Step 3Run AI-Based Data Extraction

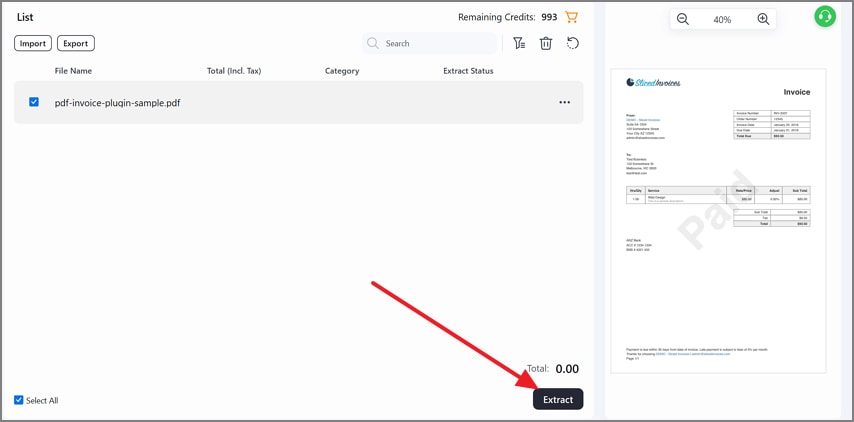

Now, select the imported invoice from the list and pick the "Extract" button at the bottom of the screen.

Step 4Review and Edit Extracted Invoice Details

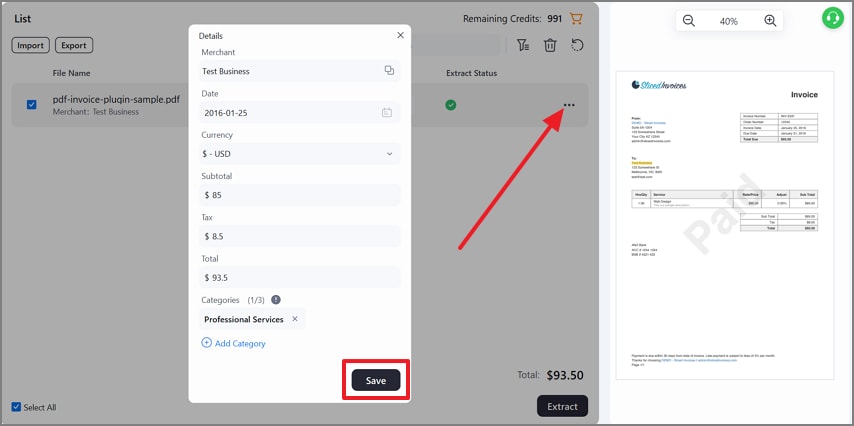

Once extraction is complete, press the "Three Dots" to view the details, and afterwards select the "Save" button to save the details.

Step 5Export Structured Invoice Data

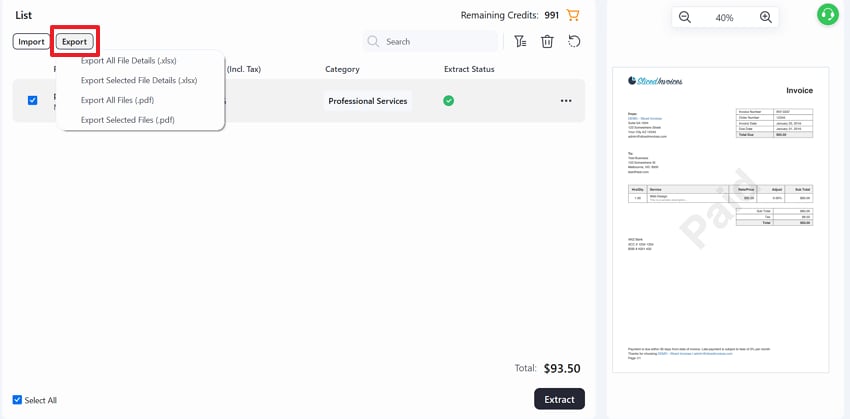

After validation, click the "Export" button from the top menu to further choose an export option to render the extracted data to your device.

Part 8. From Invoice Data Capture to Expense Tracking and Tax Filing

Once invoice details are captured and organised, they become useful for much more than basic record keeping. When invoice data is kept clean, it can be used directly in everyday finance tasks. Instead of just being stored away, invoices are checked during approvals, pulled up for audits, and reviewed during routine compliance work.

How Structured Invoice Data Supports Key Financial Tasks

Expense Reimbursement: Clear invoice data helps teams understand where an expense came from and who it relates to. It reduces follow-up questions during approvals and makes reimbursements easier to justify when records are reviewed.

Monthly Expense Summaries: Captured invoice data aggregates automatically into monthly expense overviews. Finance teams gain clearer visibility into spending patterns without manual consolidation work.

Tax Preparation and Filing: Having accurate invoice data in place supports tax calculations and expense deductions throughout the year. Clear labels and organised records make the filing process smoother and reduce the chance of errors when reporting taxes.

Why Cloud-Based Invoice Archiving Matters

Most teams move invoices to cloud storage because paper files are easy to misplace. When everything sits in one shared location, finding older invoices becomes far less stressful. If questions come up weeks later, the finance staff can usually pull the file quickly.

Part 9. Common Mistakes in Invoice Data Extraction Workflows

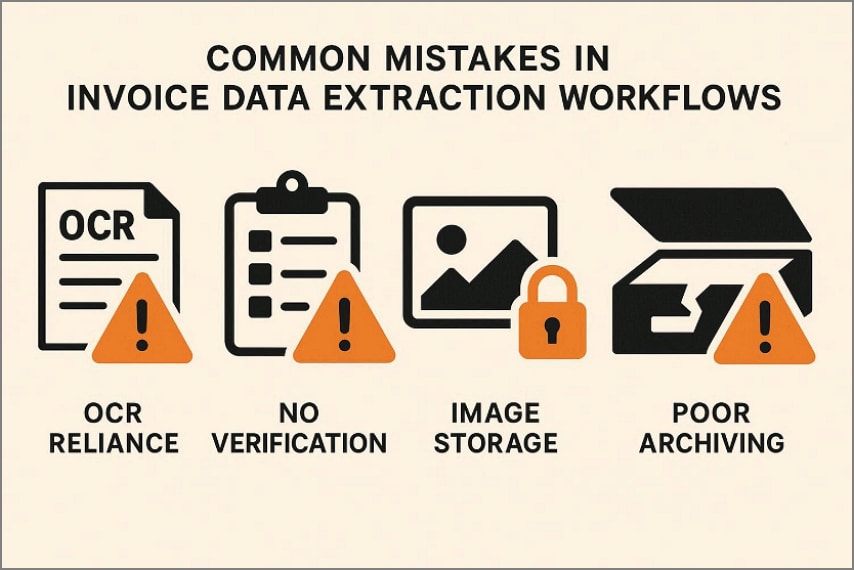

Even well-designed invoice data extraction workflows fail when critical process mistakes are overlooked. The following issues commonly reduce accuracy, reliability, and long-term automation effectiveness:

OCR Reliance: OCR alone captures text but fails to understand invoice context and field meaning. Without validation, extracted values often require corrections later during accounting processes.

No Verification: Skipping manual verification allows incorrect totals, dates, or taxes to pass unnoticed. These errors usually surface during audits, reimbursements, or reconciliation reviews.

Image Storage: Storing invoices as images prevents structured reporting and automated financial analysis. Image files require repeated scanning and slow down downstream processing workflows.

Final Step Thinking: Treating invoice scanning as final ignores validation, correction, and approval stages. Effective workflows continue beyond capture into structured processing and integration.

Poor Archiving: Improper storage increases risks of lost records and compliance failures over time. Cloud-based archiving ensures accessibility, traceability, and retention control.

Frequently Asked Questions

-

What is the best way to extract data from invoices?

In many cases, automated extraction runs alongside simple reviews to catch small issues. That mix helps invoices move faster while still avoiding mistakes during accounting or tax work. -

Can invoice data extraction be fully automated?

Invoice extraction is often automated, though human review still plays a small role. Some invoices need extra attention when layouts are complex or compliance rules apply. -

How accurate is invoice data capture software?

Modern invoice data capture software achieves high accuracy with trained models and validation. Accuracy varies based on document quality, layout complexity, and verification rules applied consistently. -

Is invoice scanning enough for tax and reimbursement purposes?

Invoice scanning alone is insufficient for tax and reimbursement compliance requirements in practice. Structured extracted data with verification is required for audit reporting and approvals processes. -

How can I reduce manual invoice data entry?

Invoice scanning alone is insufficient for tax and reimbursement compliance requirements in practice. Structured extracted data with verification is required for audit reporting and approvals processes.

Wrap-up: Turning Invoices Into Reliable Financial Data

To conclude, data extraction from invoices helps teams handle paperwork in a more reliable way. When information is captured clearly, errors drop, and invoices move through reviews faster. As invoice volumes grow, automation helps teams stay organized without losing track of details. In practice, PDFelement supports this work by handling scanning, extraction, checks, and secure storage.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure