Home

>

Other IRS Forms

> How to Fill in New W-4 Form 2025

Home

>

Other IRS Forms

> How to Fill in New W-4 Form 2025

At one point or another, the need to fill 2024 W-4 form and submit to your employer for processing has arisen, especially when you need to communicate about the necessary financial deductions to be made. However, getting convenient means to work on the PDF document without altering its original form can be a difficult task. Fortunate for you, that has been made easy by form filler tools such as Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement.

It is a program that has high usability and allows you to create, organize and secure files, without altering the formatting or style of your document. This article details the filling out a 2024 W4 form, which is essentially a form that authorizes your employer on the amount of taxes to withdraw from your paycheck.

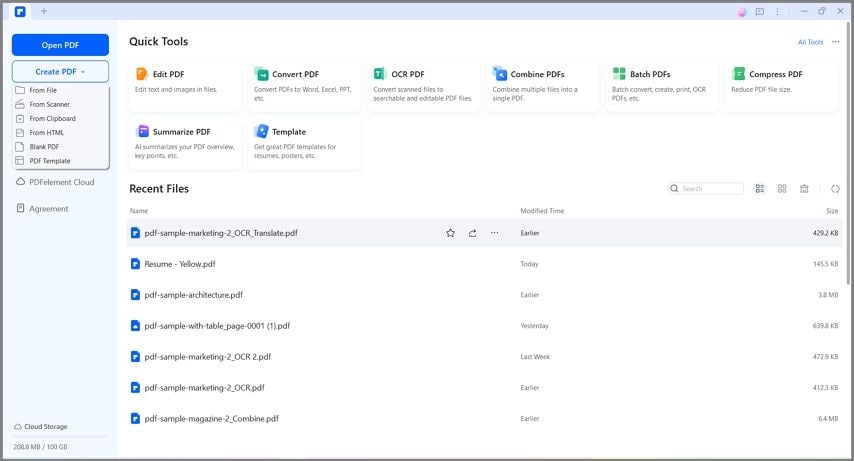

There are myriad reasons that make PDFelement ideal for filling out your PDF forms. The program has a great and friendly text editor that prepares content the way you need it. It fixes your offline documents without losing the original format or damaging the original file. While text editing, you can get to change words, lines, or the entire paragraphs easily.

It makes it possible for you to create PDF forms, convert PDFs, organize and merge PDF files. Additionally, the program also guarantees security for your data as you can only share with whoever you wish, and also can encrypt passwords at will.

How to Fill the New W-4 Form 2024

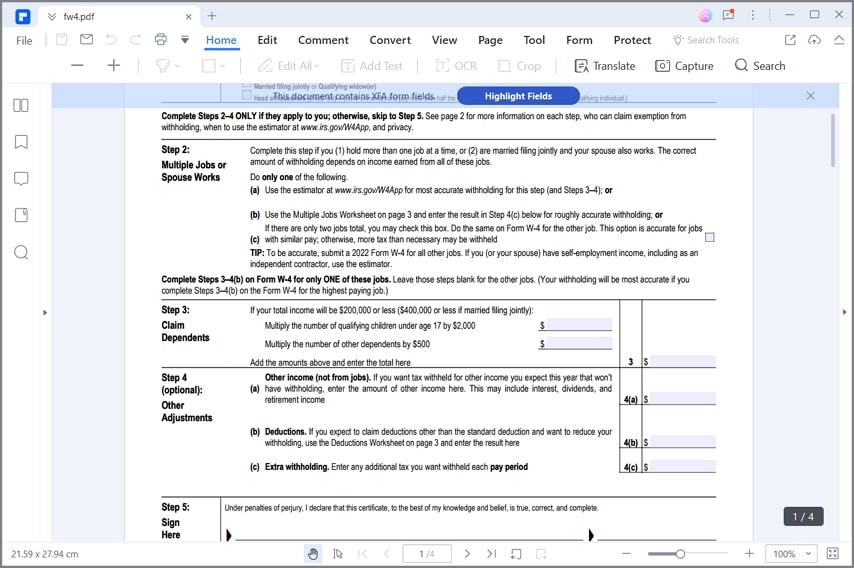

Step 1: Here, you start by downloading the IRS form from the website. It is in PDF form, and then open it in the PDFelement program. On opening the program click on "Open File" and upload form W4 2024.

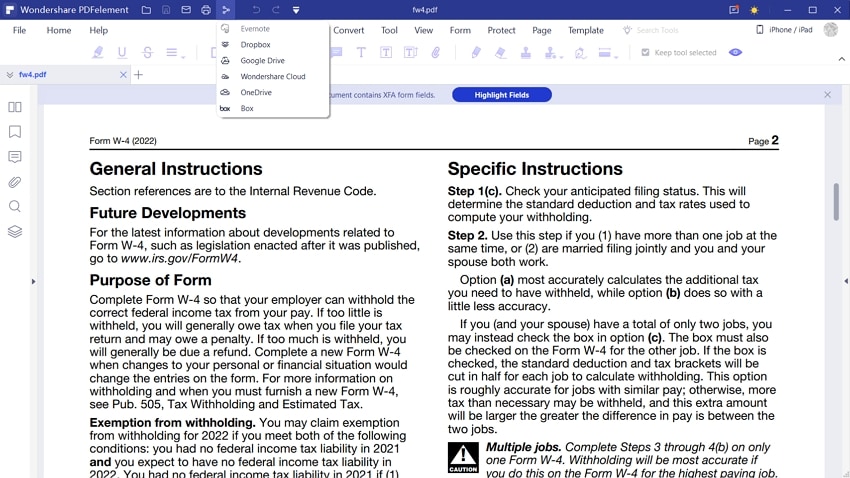

Step 2: Before setting out to fill out the IRS form, ensure that you read the instructions carefully. Most IRS forms consist of both general and specific instructions. The instructions are meant to aid you in providing the necessary information on the form. You are not about to make errors as they are expensive. All you need to know is to first prepare the information that you will need to provide in the IRS form.

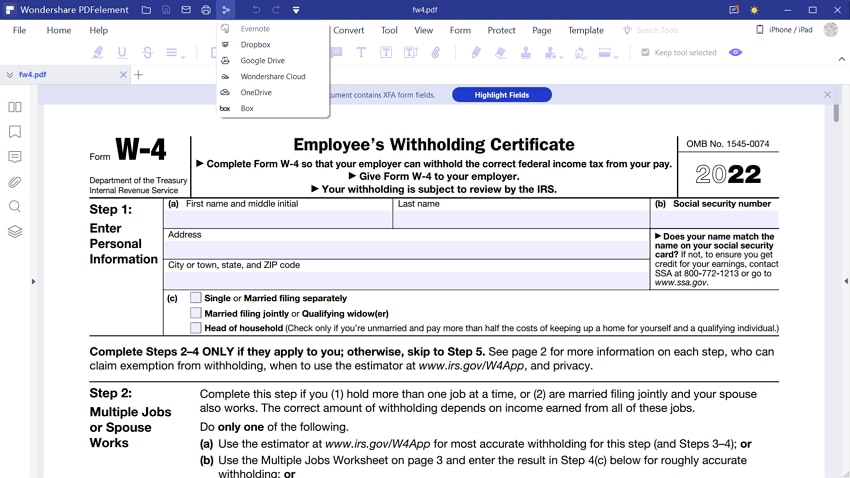

Step 3: Fill out the personal information accurately. Such include your full official names- which you get to fill out on text spaces provided. For your marital status, there are open boxes that need to check or tick, and also your social security number. Some forms require that you indicate your region or city and also personal addresses. It is important to observe accuracy while filling out the information on the form. This ensures that there is no mix-up or errors that may cost you later. Additionally, ensure that you provide only correct information so that you are not liable for any misinformation.

Step 4: After filling out the identifying information at step 1, then now head to step 2. For step 2 to 4, this is only applicable for persons who have more than one job at the same time or if you are married filing jointly and both you and your spouse are employed. More instructions are available at the end of the document. Therefore, consider checking before ticking the boxes.

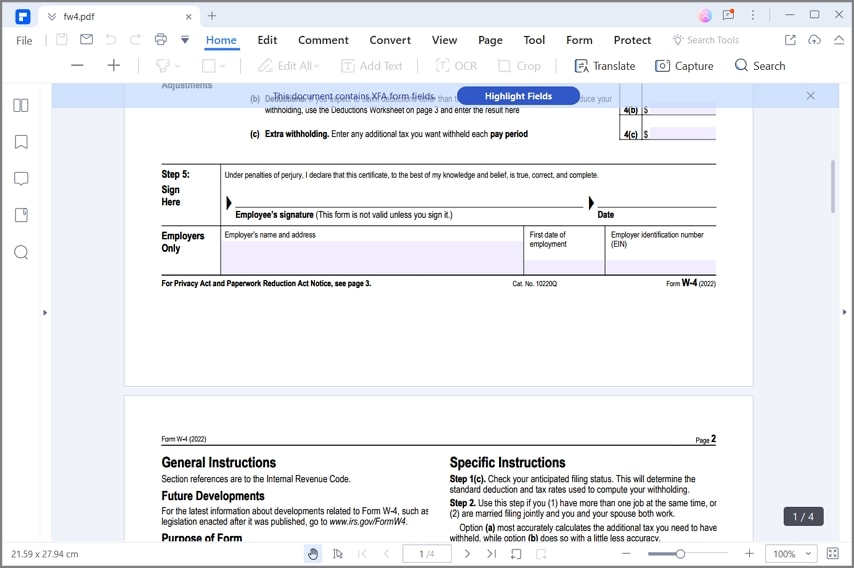

Step 5: After that scroll to step 5. Here you need to append employer's signatures. Before submitting the form to your employer, you are required to append your signature in order to confirm that it is authentic and also to commit and declare that the information you offered is true to the best of your knowledge.

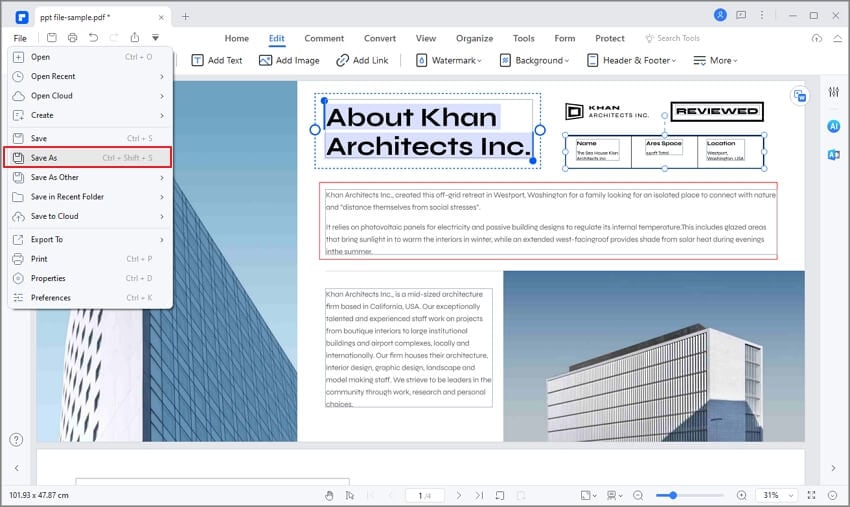

Step 6: Finally, you can then proofread the information you have provided on IRS form W4 and save the file. Click on "File" and then click on "Save As" and browse the location to save your form so that you can easily trace it when submitting it.

Tips and Warnings for Filling IRS Form W-4 in 2024

- 1. When filling out the form, ensure to observe the accuracy of the information that you are providing. This is because errors are costly and may impact your earning negatively. Hence, the figures and data filled out should be genuine and correct.

- 2. Ensure to accurately complete the form to avoid the big balance due at tax time, and also to avoid overtaxes.

- 3. Ensure that you accurately calculate all your allowances so that you instruct the employer to release the most to your accounts. This is possible if you take time to read through the instructions, fill out the correct data in the form and submit.

- 4. Using PDFelement to fill out your IRS form is safe. Your data is safe and can only be shared with those whom you authorize. You can also create, manage and encrypt passwords at will.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor