Home

>

Other IRS Forms

> How to Fill out IRS Form W-4P

Home

>

Other IRS Forms

> How to Fill out IRS Form W-4P

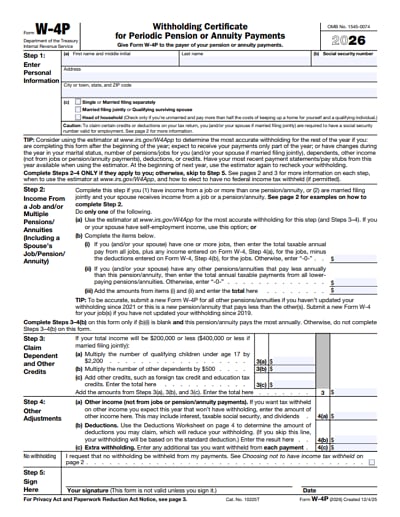

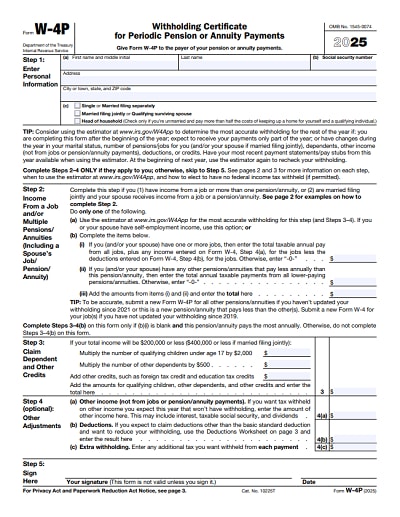

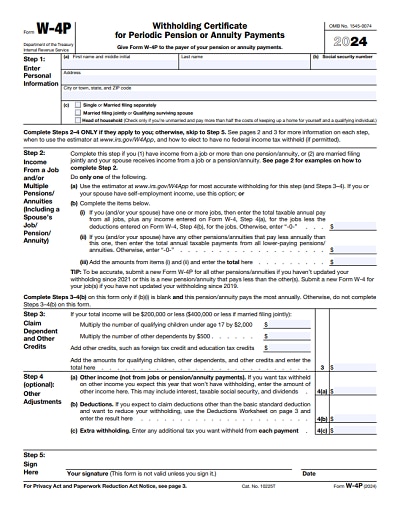

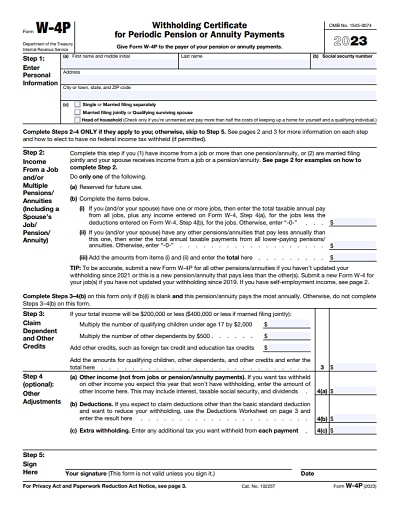

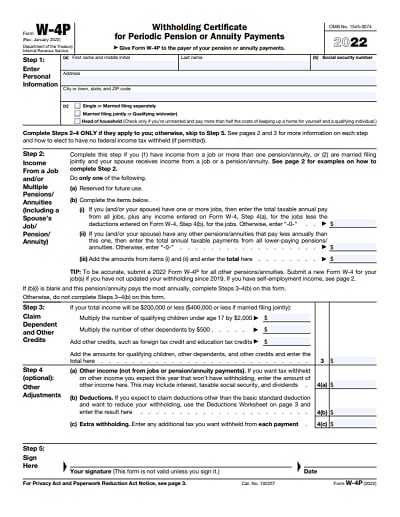

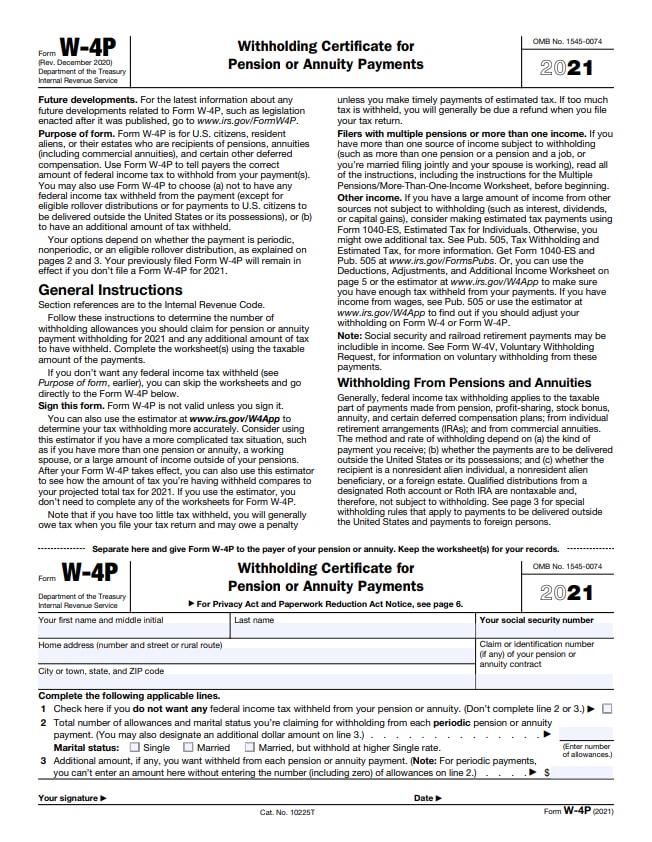

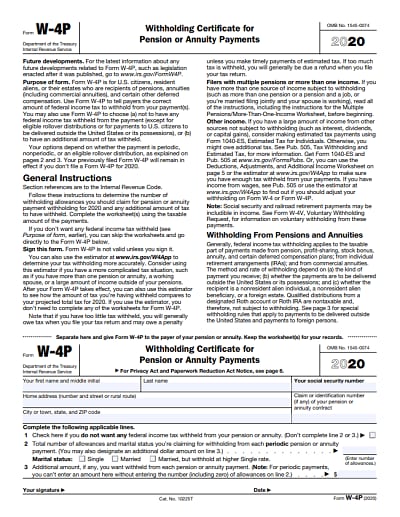

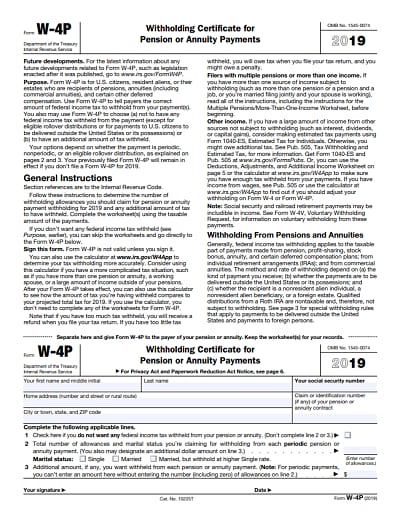

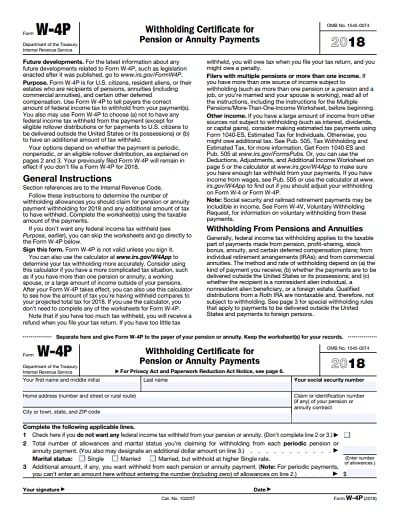

The employer will take care of the estimated tax payment of the employee by withholding money from the employee's paycheck based on their W-4. If you are a receiver of pensions, annuities and other deferred compensation, you are expected to use the IRS Form W-4P to tell the payers the correct amount to be withheld from your federal income tax.

File Taxes Faster with PDFelement

Scan receipts and paper forms into searchable PDFs

Compress large PDFs for easy storing and sharing

Securely save and back up tax records as PDFs

Organize tax files by year and category

Merge related tax forms, statements, and receipts into one file to reduce clutter

Download Printable, Fillable IRS Form W-4P in PDF

Your Best Solution to Fill out IRS Form W-4P

Filling PDF forms manually is gradually given way for electronic form filling and there are several ways to do that. However, not all form fillers give you the perfect solution for all your PDF needs. The most tested form filler which gives you all that is required to fill out your IRS Form W-4P is Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement .

With this program, you can fill out PDF forms easily by writing on the form, checking boxes and selecting radio buttons. PDFelement is an all in one PDF editor capable of solving all your PDF needs. In fact, it is a valuable tool all professionals should have for their business and personal needs.

Other features of this great software are: Editing PDF files, conversion from various formats as well as image files, availability of standard encrypted digital signatures, very friendly user interface, document password setting, impressive product speed, watermarking and a lot of other features. The good thing is that it is affordable and available in Mac and windows platform. It is surely the best solution to fill out your IRS Form W-4P.

Instructions for How to Complete IRS Form W-4P

Completing the IRS Form W-4P is easy and should not take a long time to finish. The following steps will help especially if you are new to filling the form.

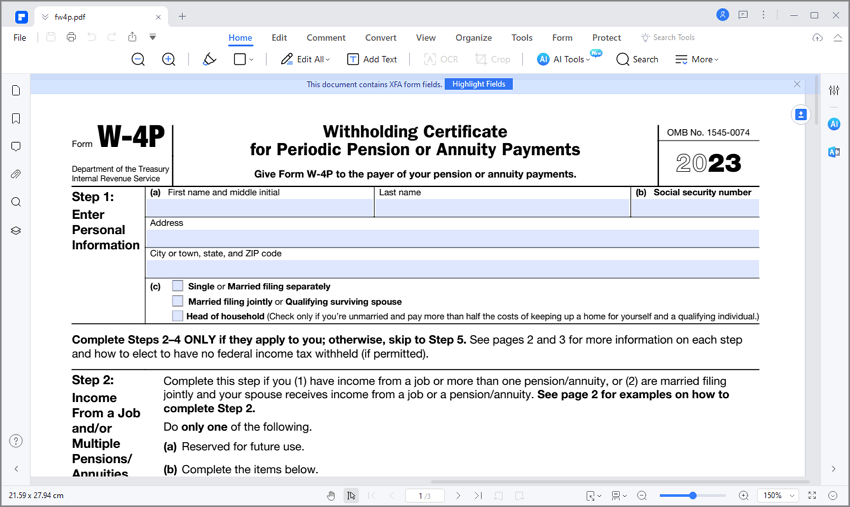

Step 1: There are several ways to obtain the form. You can obtain the form from an IRS office or you can download the W-4P form and the filling instruction from the IRS official website, then open it on PDFelement and begin filling it out with the program.

Step 2: The first part of the form is the worksheet and you can keep that for your record. Go to the form proper, write your name. It should be the first name, middle name and last name in that order. Enter your social security number and write your address. Your address should contain street, city, town, state and zip code.

Step 3: For line 1, check the box if you do not want any federal income tax withheld from your pension or annuity. If you check the box, then you do not have to complete lines 2 and 3.

Step 4: Enter the figure of the total number of allowances and the marital status you are claiming for withholding from each periodic pension or annuity payment. Enter the number on the space provided on line 2. Then check the marital status of either single, married, married but withhold at higher single rate all represented with a box. Check the appropriate box.

Step 5: Proceed to line 3. Enter additional amount if any you want withheld from each pension or annuity payment. However, note that for periodic payments, you will not be able to enter an amount without entering the number of allowances on line 2. Enter the amount on the space in front of the dollar sign on line 3

Step 6: Sign your signature and write the date that the form was signed on the spaces provided under line 3.

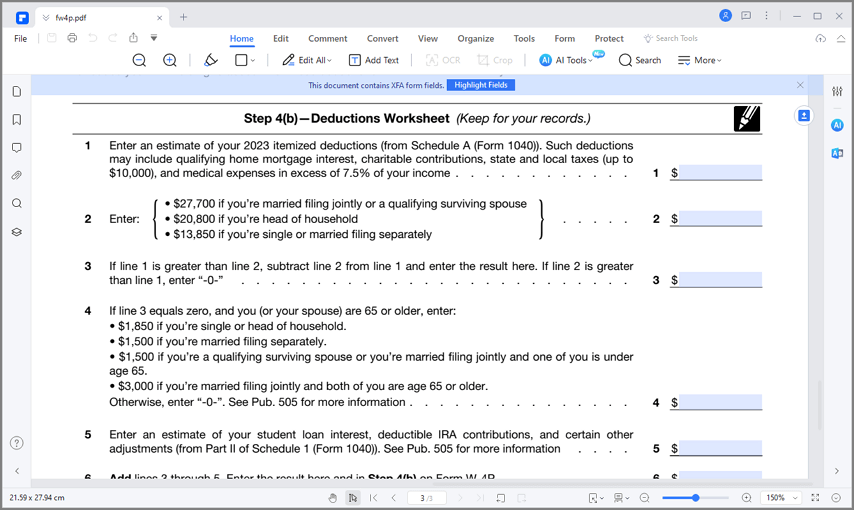

Step 7: The next page is the Deductions and Adjustments Worksheet. You are allowed to use this worksheet only if you plan to itemize deductions and claim certain credits or adjustments to income. Enter the relevant figures and make your calculations from lines 2 to 9 of the worksheet. However, note that when you get the total on line 10of the worksheet, it forms the amount you are expected to enter on form W-4P line 2 above.

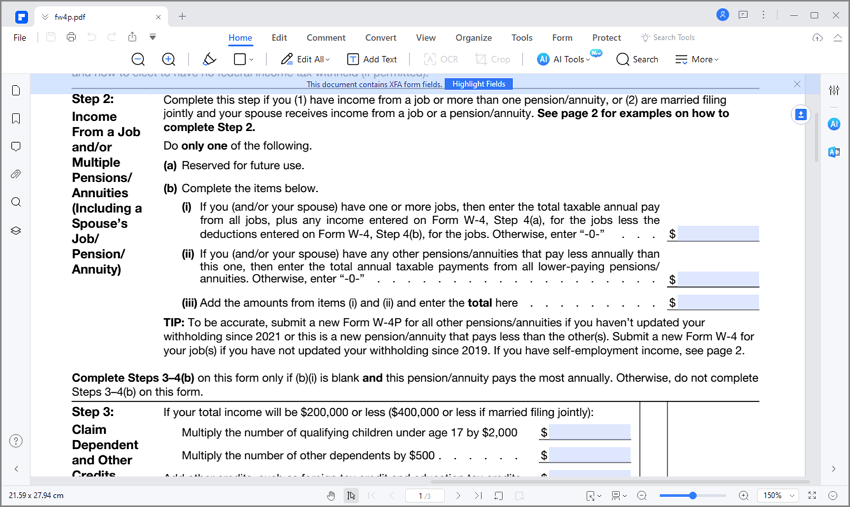

Step 8: If you sue the Multiple Pensions/ More-Than-One-Income-Worksheet, then note that it applies if you are married and you and your spouse is filling jointly, having more than one source of income subject to withholding, for example, more than one person, a pension and a job etc. Enter the figures and make your calculation. Note that the result will be entered on line 3 of the form W-4P above.

Tips and Warnings for IRS Form W-4P

- The essence of the additional worksheet is to further adjust your withholding allowances for itemized deductions, adjustments to income, certain credits etc. You can skip the worksheet if you do not want any federal income tax withheld and just go directly to the form.

- If you do not have enough that has been withheld during the year from your income, it is possible that you can find out that you owe the Internal Revenue Service in penalties and interest when you file your tax return at the end of the year.

- It is important to note that once you file your IRS Form W-4P, it will stay in effect until another new one is submitted. But note that you are at liberty to submit a new one when your life situation changes. For example, in a situation where you retire completely and your pension becomes only source of income, then you may claim an additional allowance.

- The Internal Revenue Service has created a page on irs.gov to help you with additional information about the IRS Form W-4P and its instructions and every future development will be posted on the page.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure |

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Elise Williams

chief Editor