Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form 8889

Home

>

Other IRS Forms

> Instructions for How to Fill in IRS Form 8889

If you’re the recipient of a health savings account or HSA, then the IRS would require you to submit Form 8889 together with your tax return before you are allowed to deduct your assistances to the account.

Your Best Solution to Fill out IRS Form 8889

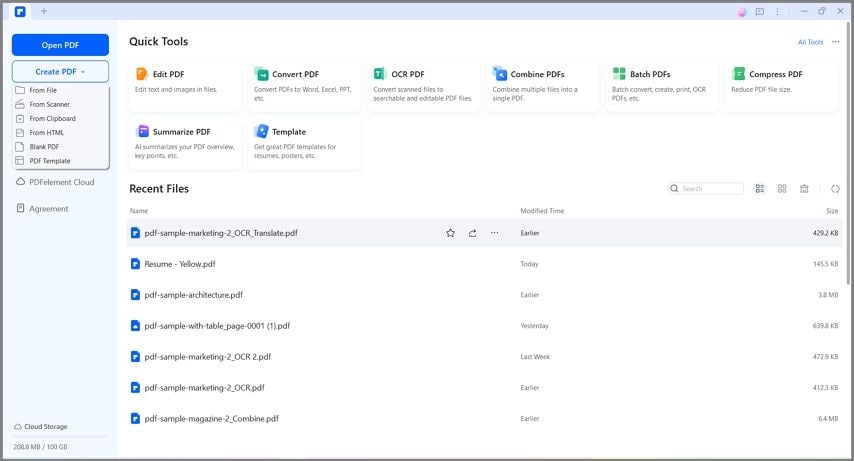

If you need to fill out IRS form 8889, then Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is one of the most reliable and full featured PDF form fillers you can use.

The purpose of this Form 8889 is to report the deductible contributions, estimate the deduction, report the distributions that you take in paying medical expenses, and to calculate the tax you have to pay on withdrawals you make for non-medical related reasons. PDFelement can meet all your needs since it includes the features for filling form, converting files from or to PDF from, making PDFs, combining and editing PDF documents, OCR support and so on.

Key Features

- The program has a user-friendly and neat interface that is easy to navigate.

- It allows the user to sign PDF with digital signature.

- Create PDF from all the file formats you can imagine.

- Support adding headers and footers to your official documents.

Instructions for How to Complete IRS Form 8889

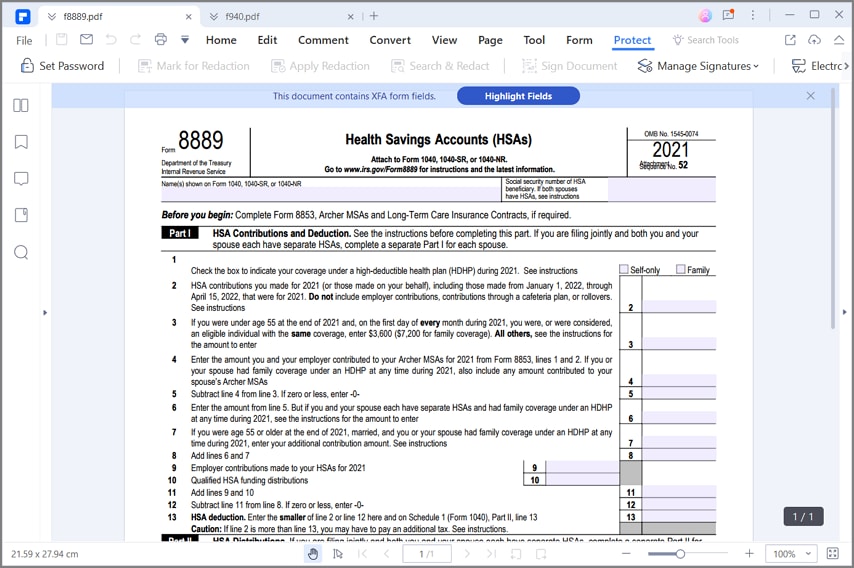

Step 1: Find and download the latest version of Form 8889. It is going to be included in your Form 1040 book or you can download it from the Internal Revenue Service's website. Import the form in PDFelement.

Step 2: Before filling out Form 8889, you have to indicate whether you had an individual or family high-deductible health plan for the year. If you didn't have a high-deductible health plan for the entire year, then you have to refer to the instructions to define how much of a tax deduction applies. If there are extra contributions made into your account, they have to be withdrawn from the account before you file your tax return, or they'll be subject to a 10% excise tax.

Step 3: Complete Part I. the Fill out the lines 1 through 13 of the form as instructed on the form. But if both of you and your spouse are filing together, it means that both of you are qualified individuals and either of you have an HDHP with family coverage, both of you are treated to have the family coverage plan. Self-only coverage plan is not going to be suitable for you.

Each spouse has too complete a separate Form 8889. On Line 13 of both Forms 8889, the amounts have to be combined and then enter the same amount on the line 25 of Form 1040; or on the Line 25 of Form 1040NR. Don’t forget to submit both Forms 8889 together with the paper tax return.

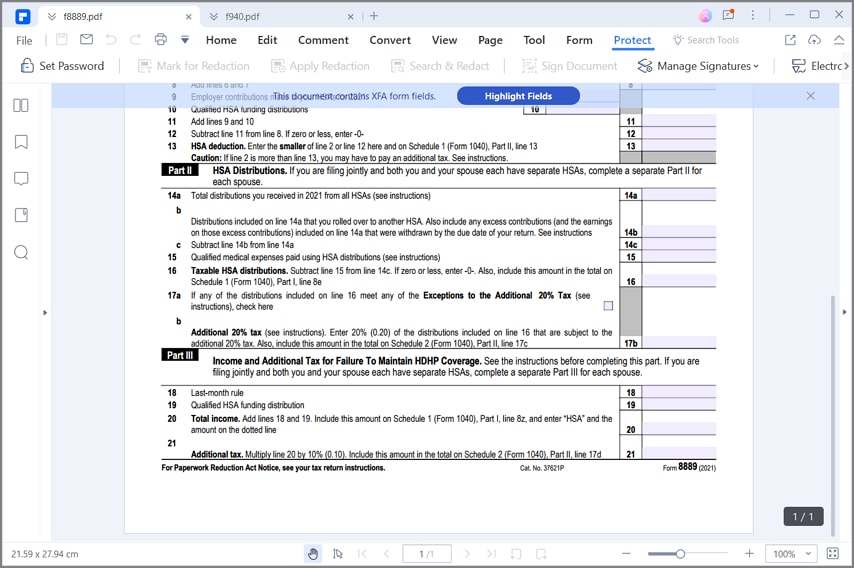

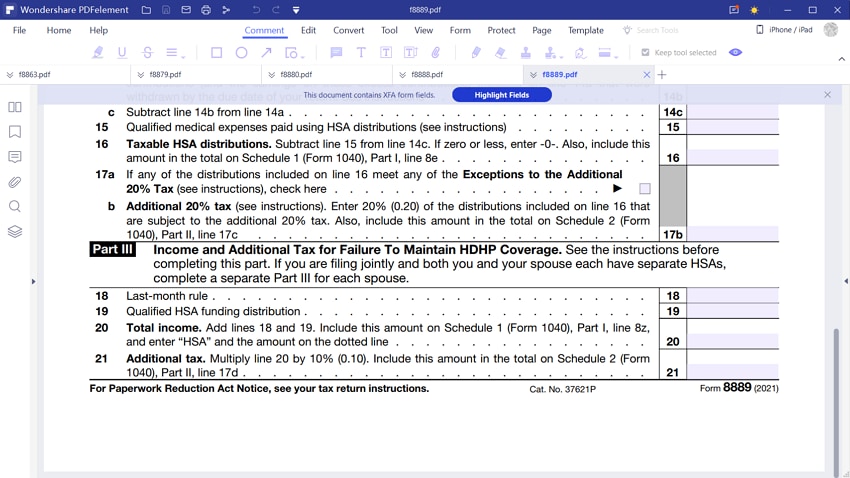

Step 4: Complete HSA Distributions on Part II. This part is used by the taxpayers in reporting distributions from the HSA. Taxpayers get tax-free distributions from an HSA to make them pay or reimburse for qualified medical costs. The taxpayer is going to make to tell you the types of costs reimbursed or paid with the distribution.

Step 5: Complete Income and Additional Tax on Part III. This part defines if any penalties or taxes apply to amounts added when an account holder isn’t qualified to contribute. Remember that HSA eligibility is only effective when contributions could be made to an HSA, instead of when money in the HSA could be spent. The fund in the HSA is useful for the account’s lifetime, in spite of the status of the insurance.

Tips and Warnings for IRS Form 8889

- Keeping precise records of your health savings account distributions and contributions through the year are able to save lots of time in completing Form 8889.

- Contribution restrictions are set by the IRS every year and include the contributions of both employer and employee. It’s your responsibility to make sure that you don’t exceed the total contribution limit of the year.

- Maximum limits for year 2015 are $3,350 for individual coverage and $6,750 for family coverage.

- Individuals that age 55 or older are able to make additional catch-up contributions up to $1,000.

- You must not owe taxes or penalties on HSA distributions for qualified medical expenses. If you used HSA funds for non-qualified medical costs, you have to pay income tax and will possible have to pay an extra 20% penalty on those distributions.

- If you have any concerns or questions, you can talk to an accountant who is accustomed with health savings accounts.

- Donating more to your health savings account than the supreme allowed will end up more taxes due.

- It is recommended that any extra 2015 contributions be made by April 1, 2016 to make sure time for processing. Furthermore, be conscious that extensions to file your taxes do not extend the contribution window further than April 15.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Margarete Cotty

chief Editor