Home

>

Other IRS Forms

> How to Fill IRS Form 8879

Home

>

Other IRS Forms

> How to Fill IRS Form 8879

Are you an electronic return originator and you want to digitally authorize signature on IRS form 8879? Then you are reading the right article. The US government requires electronic return originator (ERO) to file tax form 8879, a declaration document and signature authorization for an e-filed return. This form is to be retained by the ERO unless requested by the IRS. Therefore, as an ERO you need to get yourself software that simplifies you filing of IRS 8879.

The Best PDF Form Filler for 8879

Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement comes in handy for you as an ERO since it fully integrated PDF form. To begin with, you can electronically add your digital signature to the PDF form of 8879 without having to print it out and sign it manually. Moreover, PDFelement allows one you to fill out the form texts, add images and links. You can optimize the font size, colour as well as the font style. This PDF utility also allows you to create PDF forms and use its OCR technology to edit image-based forms.

Furthermore, if you want to save your form 8879, this software allows you to send it to Google Drive, share it via Email or Dropbox. Incredible right? To add on, this software can protect PDFs with passwords, redacts PDFs, create PDF from different file formats and convert PDF to editable formats within a click while retaining its format. As you have seen, this software is a must-have for any ERO when filing tax form 8879.

Instructions on How to Fill IRS Form 8879

In this section, we can now show you how to use PDFelement to file IRS form 8879 and save it on your computer or Google Drive. Let us get started.

Step 1: Download the software to your computer and install it. PDFelement is compatible with Windows and Mac platforms, therefore, ensure you download the right version.

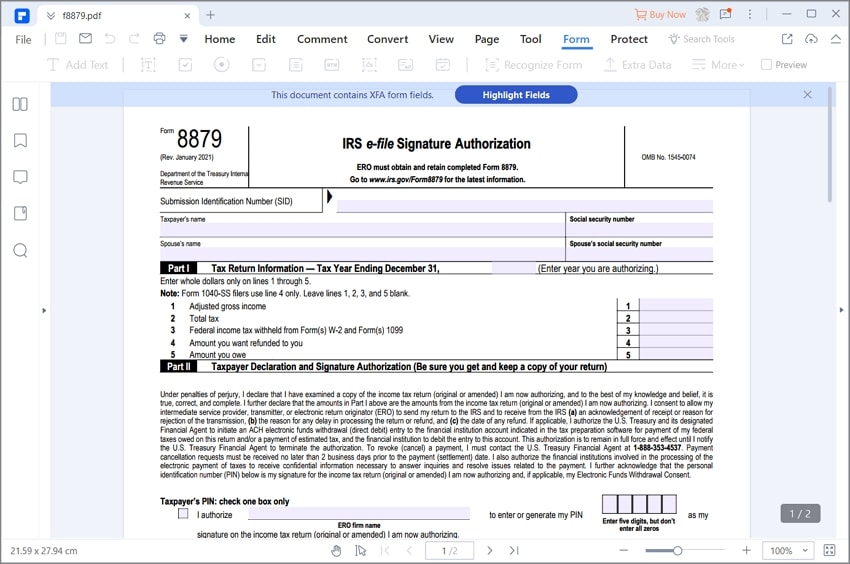

Step 2: Now you can download the IRS form 8879 here.

Step 3: Upload the form 8879 to the program. To do so, click on "Open File" button at the bottom left and browse for the form. On locating it, click on it and open it with the program.

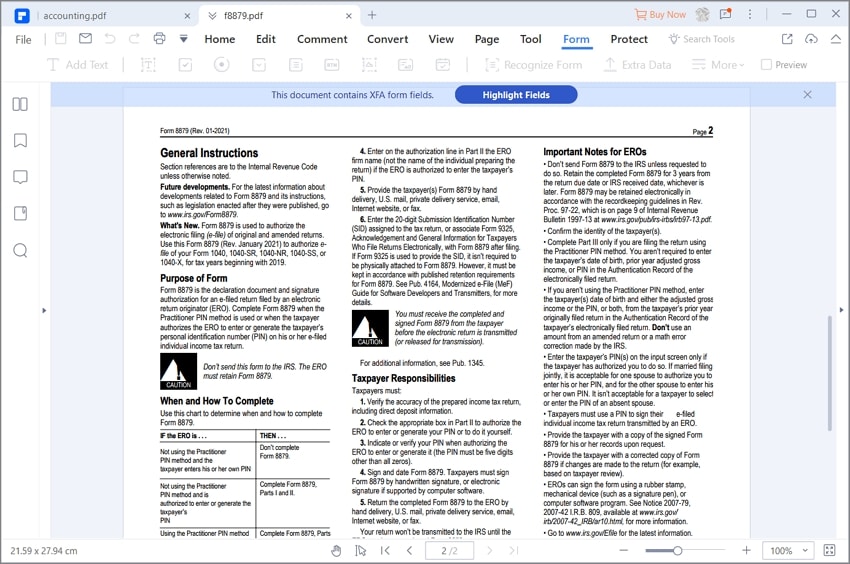

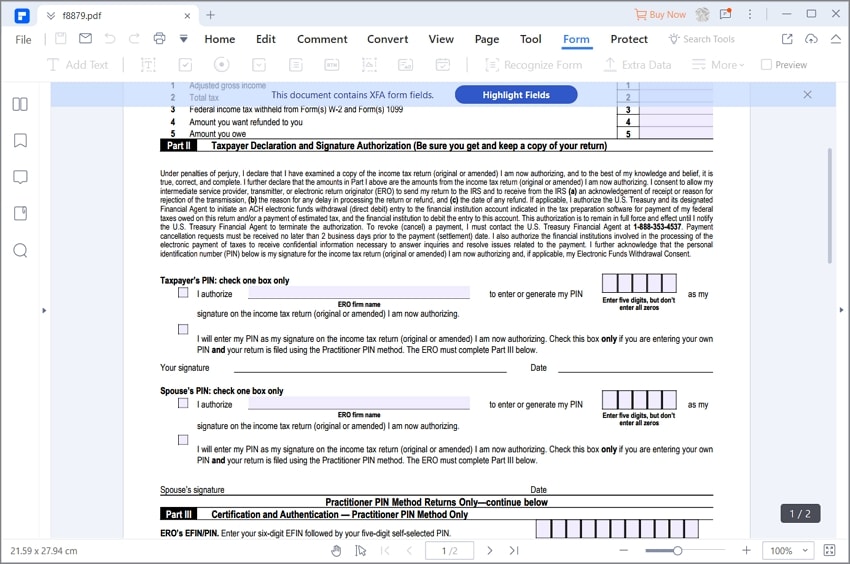

Step 4: You will then see the form 8879 opened the program. You can start filling out. But before filing it consider going through IRS form 8879 general instructions at the last part of the document.

Step 5: When you start filing click on the field, say the SID field and you will be able to enter the submission ID number. Next, provide the name of the taxpayer, their social security number, their spouse name and the spouse social security number.

On part 1, you need to go through line 1 to 5 and provide the relevant amount from the taxpayer's return of the filing year. The amount should be provided in whole numbers and dollars only.

Step 6: Next, is to fill out the section on. This part entails the authorization of signatures for both the taxpayer and their spouse. On the taxpayer box, click on authorize and enter your firm name of the ERO and enter a pin or you can generate the pin as your signature. From there authorize the Spouse section again and proceed.

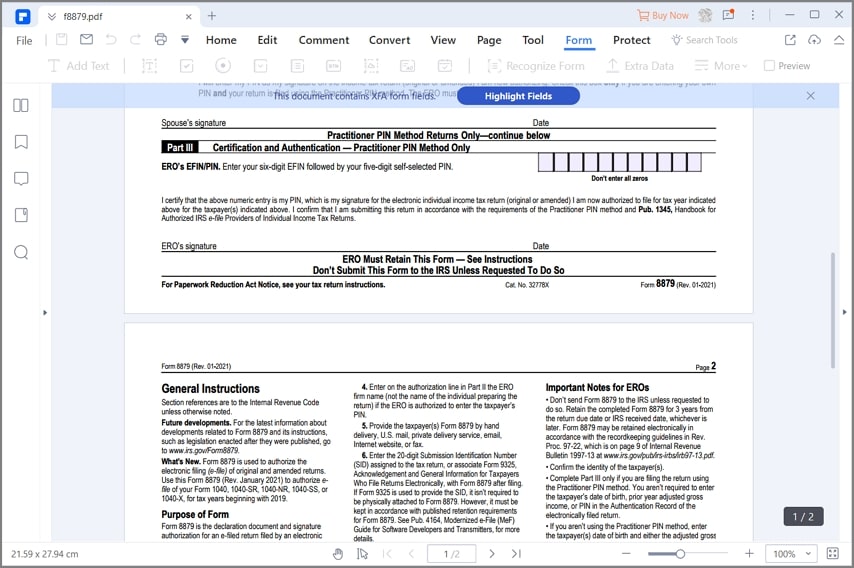

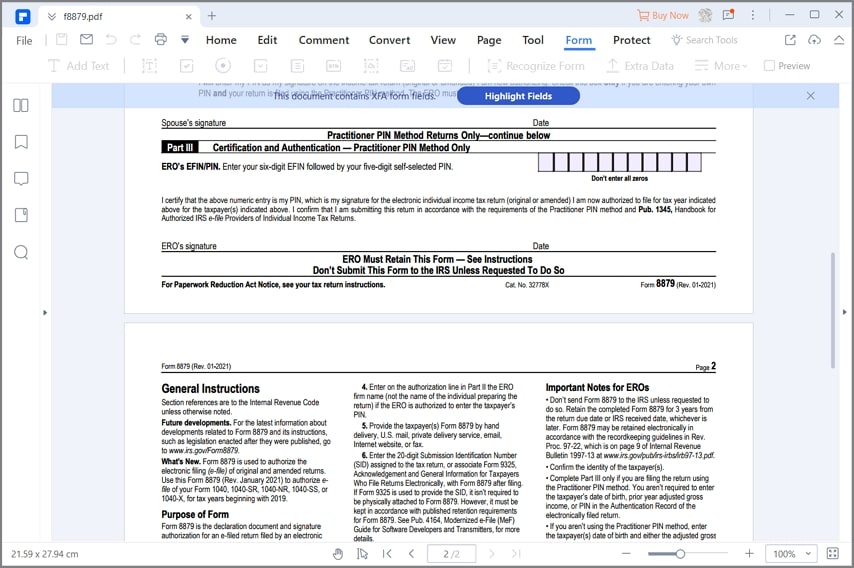

Step 7: After that, you can now proceed to section three. This part is on certification and authentication. The first line requires you to enter the EROs, EFIN and Pin. Begin with 6-digit EFIN and enter a five-digit PIN.

Next, confirm that the numeric PIN provide is yours by entering your signature and the date certified. On the PDFelement menu, click on "Comment" and you will see the signature option. You can create the signature and add it to the field. Bravo! You have filed form 8879.

Step 8: Although you are to retain this form, you need to know how to share it when requested by the IRS. Click on "Share" and choose to say "Send to Email" option. The program will save the document and attach it to email application you are using say outlook. From there, provide the recipient mail, subject and it.

Tips and Warnings for IRS Form 8879

So, what do you need to take note of when filing IRS form 8879? Here are the key tips for you.

- You are allowed to retain the form for three years from return due date or the date the IRS received the return manually or electronically.

- Note that if you are ERO and you are not using the Practitioner PIN method and the taxpayer enters his or her PIN then you are not allowed to file form 8879.

- You are allowed to sign the form 8879 using a rubber stamp, signature or computer software program hence PDFelement is the best is a software program for you.

- Ensure that the taxpayer confirms the accuracy of the prepared income tax returns and check part II.

- Always read the general instructions before filling the form.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Elise Williams

chief Editor