IRS Form 8892: Complete this Form with PDFelement

2024-04-30 10:44:14 • Filed to: Other IRS Forms • Proven solutions

You may need to request for an automatic 6 months extension of time to file form 709, especially when you are not applying for an extension of time to file your individual income tax return using Form 4868 then IRS Form 8892 can be used for this purpose.

Your Best Solution to Fill out IRS Form 8892

You could fill out your IRS Form 8892 in several ways. However, if you desire a stress free, easy and reliable form filling process, then it is advisable to use Wondershare PDFelement - PDF Editor.

This is in fact the best all in one tool for all your PDF operations. Your IRS Form 8892 is a PDF document which requires the best form filler to ensure it is filled correctly. This is what PDFelement will guarantee you.

Besides its form filling features, it's featured with other amazing features like friendly user interface, supporting digital signatures, availability in both Mac and Windows platform, editing functions, watermarking as well as many others. Filling out the IRS Form 8892 using PDFelement is easy and straightforward. All you need to do is to open it on the platform and use the form filling program to fill it out. No wonder it is considered to be the best form filler.

Instructions for How to Complete IRS Form 8892

Do you have an IRS Form 8892 to fill out? The following step by step guide will be helpful in completing the form.

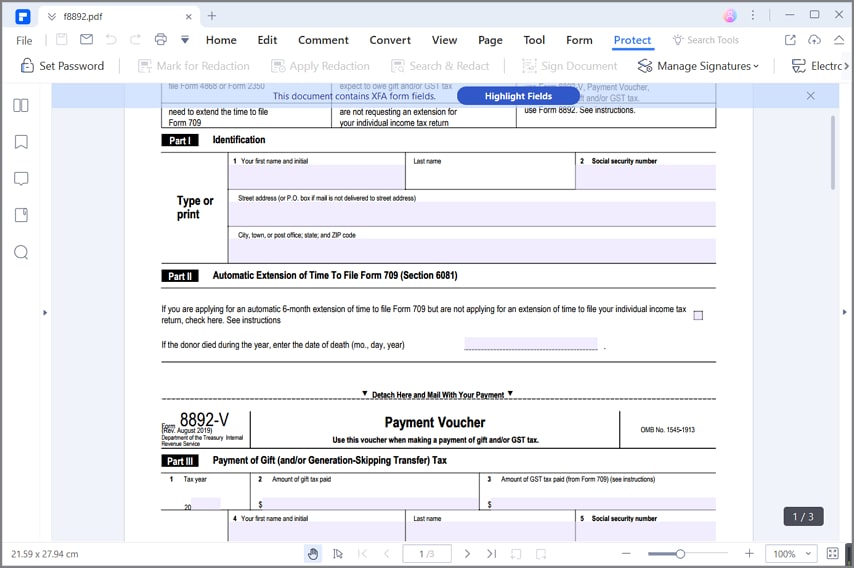

Step 1: It is important that you download the official copy of the form. The best place to get it is at the official website of the Internal Revenue Service. You can also download the filling instructions. Then open it with PDFelement and start the filling process.

Step 2: Begin Part I-Identification. First write your first name and initial, followed by your last name and your social security number. Then write your address below. Note that your address must contain street, city, town or post office, sate and zip code.

Step 3: Complete Part II- Automatic extension of Time to File Form 709. You can apply for an automatic six months extension of time to file your form 709. You can do this by checking the designated box. However, note that you do not have to explain why you are applying for an automatic extension; you will only be contacted if your request is denied.

Step 4: If the donor died during the tax year , note that Form 709 may be due before April 15, therefore you are advised to see the instructions for Form 709 to determine the due date. However, the maximum extension that can be granted is 6 months from the initial due date. Therefore, enter the date of death. This will include the day, month and year.

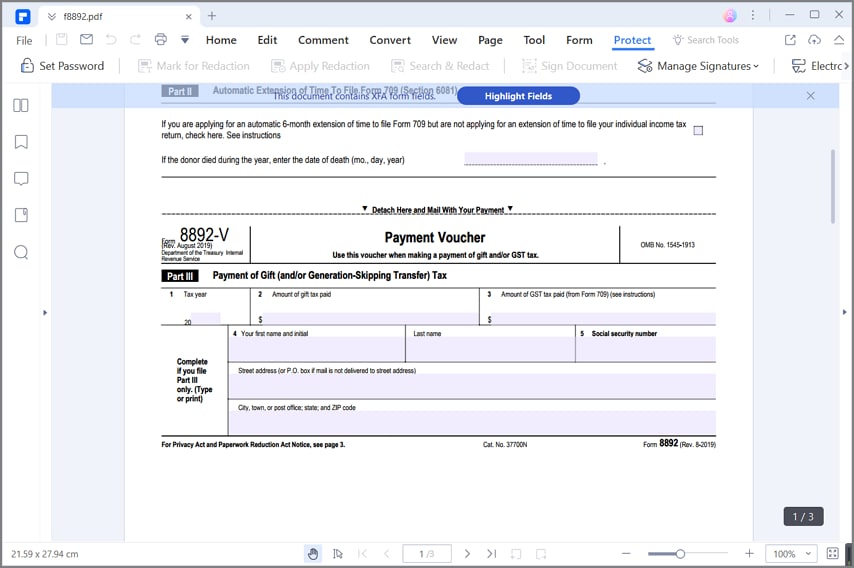

Step 5: Go to Part III-payment of Gift(and /or generation skipping transfer) tax. It is important to note that if you are making a payment of gift and /or generation skipping transfer taxes that is due with form 8892, then only part III must be completed and sent to the IRS. In box 1, you are expected to enter the calendar year for which the gift is being paid for or in which the generation skipping transfer taxes is due.

Note that you are not required to enter the year in which you are filling the IRS form 8892 In box 2, enter the amount of gift card paid while you are expected to enter the amount of the generation skipping transfer tax paid from Form 709. However, the only generation skipping transfer tax you are expected to pay with form 8892 is the tax on the direct skip that is reported on Form 709. Box 4 should be completed if you are filling part III only. In that case, write your name starting with your first name and initial, then followed by your last name. Then enter your social security number and your address. Note that your address must contain street name, city, town , state and zip code.

Tips and Warnings for IRS Form 8892

- Before you begin filling the IRS Form 8892, it is important to read the chart on top of part I of the form to be sure that you are eligible to use the Form 8892. The chart explains different scenarios where you should use or not use the Form 8892.

- It is important to note that the IRS Form 8892 cannot be used for joint fillings but can only be use for an individual taxpayer. In a situation where both you and your spouse are eligible to file the IRS Form 8892, you must file then differently using separate forms and mail the form in different envelopes.

- When paying by Check or money order, it is important that you make your check or money order payable to the United States Treasury. Do not pay cash. Enclose your payment with the detached and the completed payment voucher. However, you are warned not to attach or staple your payment to the voucher.

- It is important you change your address by filing Form 8822 to notify IRS of the change instead of writing a new address on your IRS Form 8892 if you have changed your mailing address after you filed your last return. This is because changing your address on your Form 8892 will not update your records.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Buy PDFelement right now!

Buy PDFelement right now!

Margarete Cotty

chief Editor