Home

>

Other IRS Forms

> How to Fill out IRS Form 4852

Home

>

Other IRS Forms

> How to Fill out IRS Form 4852

How do I file a substitute W-2 using Form 4852? You need to file IRS form 4852 if your employer fails to send your form W-2, a US wage and tax statement used to report wages paid to employees and the taxes withheld from them. Now, if you are in this situation and you are forced to file IRS 4852 then this article is right for you. We will show you how to easily fill the form using the best PDF form filler in the market. At one point or another, the need to fill 2020 W-4 form and submit to your employer for processing has arisen, especially when you need to communicate about the necessary financial deductions to be made. However, getting convenient means to work on the PDF document without altering its original form can be a difficult task. Fortunately, hat has been made easy by form filler tools such as Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement.

The Best PDF Form Filler for Form 4852

Since form 4852 is available in a PDF format and you need to fill it online, you will have to download to your computer fill it and then submit it. However, filing the form can be tough if you do not have the right PDF form filler. To make work easier for you we recommend that you use Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement software. It is a PDF software utility that is built with an intuitive PDF form filler. It allows you to edit texts, links, and images. You can also organize pages, annotate PDFs or merge PDF files if you are to attach any other IRS form not to mention that you can also create PDF forms.

The Instructions on How to Fill IRS Form 4852

At this point, we can now see how to fill IRS form 4852 with PDFelement. This software supports both Mac and Windows platforms and the steps are similar. In our case, the screenshots take that of the Windows platform.

Step 1: Ensure that you have the PDF filler on your computer. Next is to get form 4852 online. The form is available on the IRS website. Here is the direct link for downloading form 4852 in PDF format to your computer.

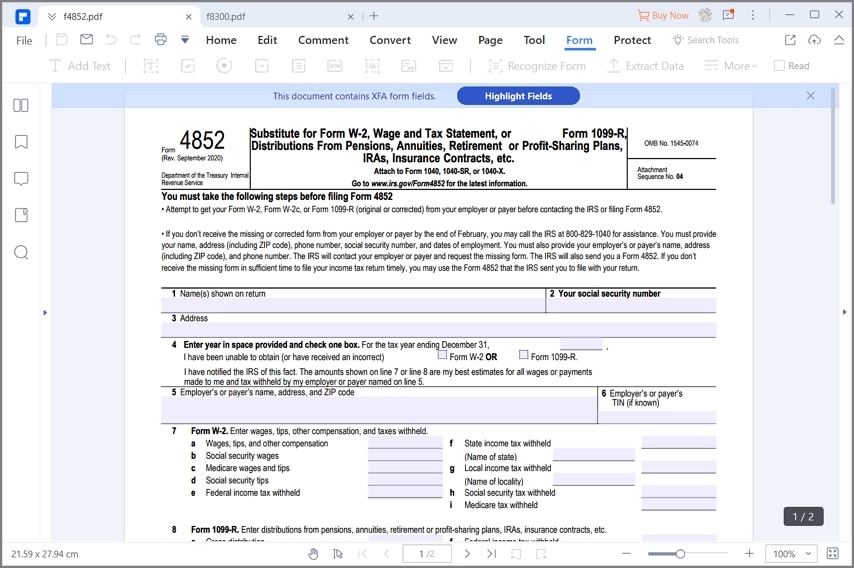

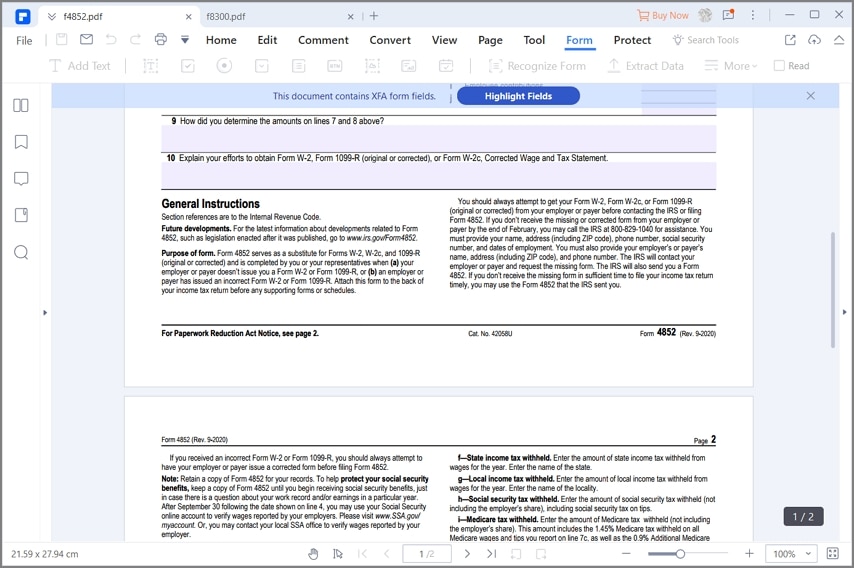

Step 2: After that, you can now open the form 4852 to the program. Now when you open the program, click on "Open File" at the bottom left. You will be able to access your local storage. Sect the IRS form 4852 and upload it. Alternatively, you can drag and drop the form to the program to upload it.

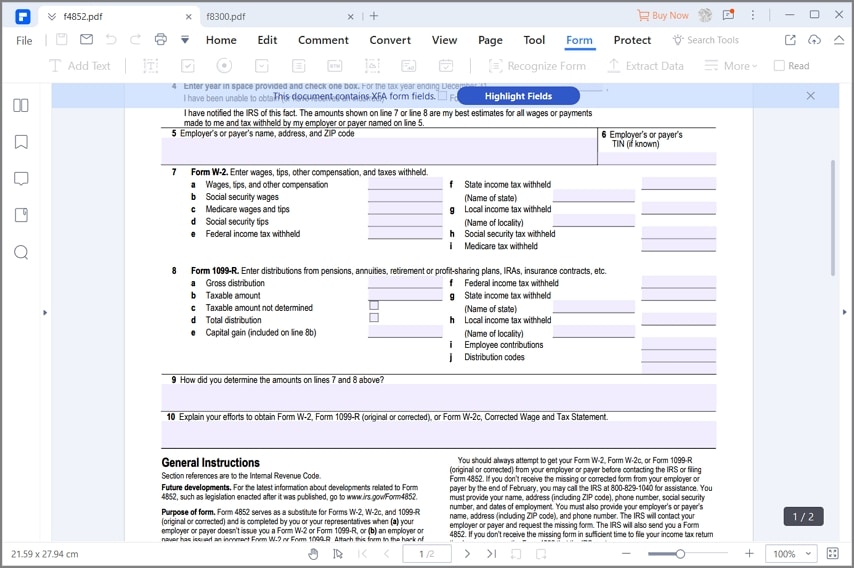

Step 3: Next, you can begin filling the relevant details on the form. Begin by providing the official names that tally on the return form and provide your social security number followed by your address. On question four, you are required to provide the tax year and tick the form that you never got from your employer if its is form W-2 or form 1099-R.

Step 4: Now, on line 5 and 6 you need to provide your employer details. Provide their name, address, zip code followed by TIN if you know it.

Step 5: After that is line 7 and line 8. Line 7 entails details for form W-2 details like wages, tips, compensation and taxes withheld. On the other hand, part 8 pertains form 1099-R details. You are required to provide details on pensions, annuities, retirement or profit-sharing, IRAs and insurance contracts among others.

Step 6: You are almost there. For line 9, you need to provide a statement on how derived at the amount you provided on line 8 and line 7. Do not write too much you can be brief but clear.

Step 7: Now the last part is line 10, which allows you to explain your efforts of getting form W-2, 1099-R or Form W-2c from your employer but failed. Give the challenges you faced and why you did not get the form.

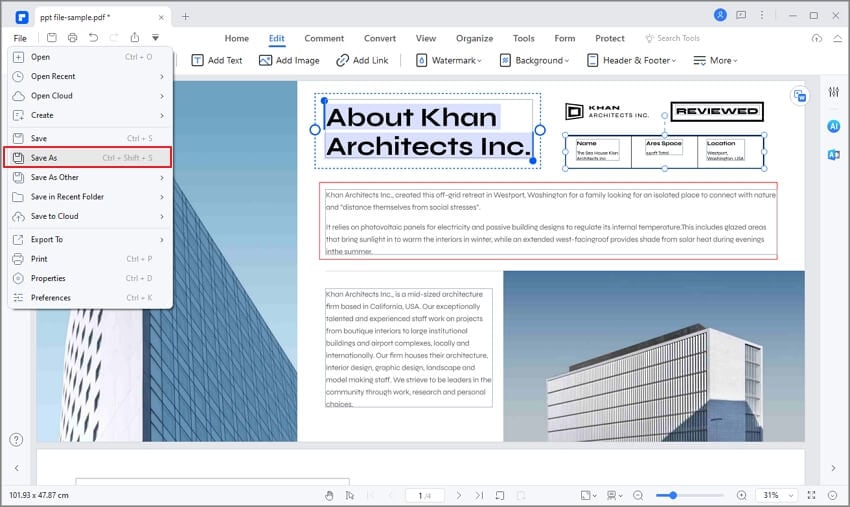

Step 8: Lastly, you can now save your file. Go through line 1 to line 10 just to ensure that you answered everything correctly. From there click on "File" and click on "Browse" on the location to save your file. Your form 4852 is now ready for submission.

Tips and Warnings for IRS Form 4852

In this section, we will tell you a few tips and warning in regards to IRS form 4852. Here are a few but important.

- Always try to get your Form W-2, Form W-2c, or Form 1099-R from your employer or payer before contacting the IRS or filing Form 4852. This also applies when your employer provides incorrect information on form W-2 Form W-2c, or Form 1099-R.

- Always make a copy of Form 4852 for your records.

- There are penalties for misusing the IRS form 4852 or when you provide wrong information.

- You should always go through the IRS instructions for form 4852 before filling it.

Free Download or Buy PDFelement right now!

Free Download or Buy PDFelement right now!

Try for Free right now!

Try for Free right now!

100% Secure |

100% Secure | G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure

Audrey Goodwin

chief Editor