Keeping track of your receipts is very important. It helps you see where your money goes. For taxes, receipts can prove what you spent. This is true for both personal budgets and businesses. Many people wonder how long they should keep these receipts. The answer can differ depending on whether it's for personal or business use.

Taxes also play a big part in this decision. Some receipts you need to keep longer because of tax rules. Today, you don't have to keep all paper receipts. Tools like PDFelement can help. They let you save your receipts as digital files. This makes it easier to keep and find them when needed. This article will talk about how long to keep receipts. We will look at both personal and business needs. We will also touch on how tech can make this easier.

In this article

Part 1. How Long To Save Receipts

Saving receipts is like keeping a map of where your money goes. It helps you stay on track with your spending and saving. For personal finance, keeping receipts can show you how much you spend on things like food, clothes, and fun. Keeping these receipts for a month or until you check them with your bank statement is good.

Keep your receipts longer for big buys like a car, furniture, or electronics. These are important for warranties or insurance. Keep these receipts for as long as you own the item.

Now, not all receipts need to stay on paper. Digital tools let you save receipts as files. This can save space and make it easier to find receipts when you need them. Knowing how long to keep receipts helps you manage your money better and stay ready for tax time, whether for personal use or business.

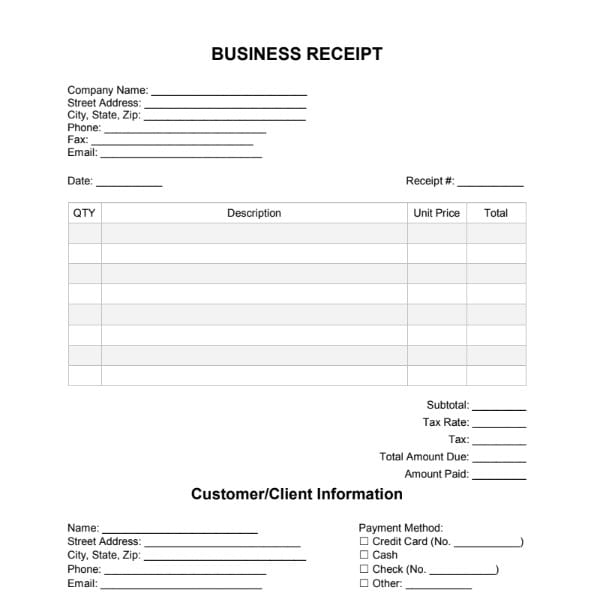

How Long To Keep Business Receipts

For businesses, keeping receipts is very important. They show what you spend on your business. This helps with tracking expenses and doing your taxes right. The basic rule is to keep business receipts for 3 years. This is because the tax people, like the IRS, might want to check your taxes from the past 3 years.

But, there are some special cases. You should have kept your receipts for 6 years if you didn't report some income. And if you have property like buildings or big machines, keep those receipts as long as you own the property, plus 7 years after you sell it. This helps with any questions about the property's cost or sale.

Some expenses also have their own rules. For example, if you have workers, keep all records related to their pay for at least 4 years. This is important for proving you paid them correctly and took out the right taxes.

Digital tools can help keep track of these receipts without needing a big file cabinet. This way, you have all your important papers saved safely and can find them easily when needed.

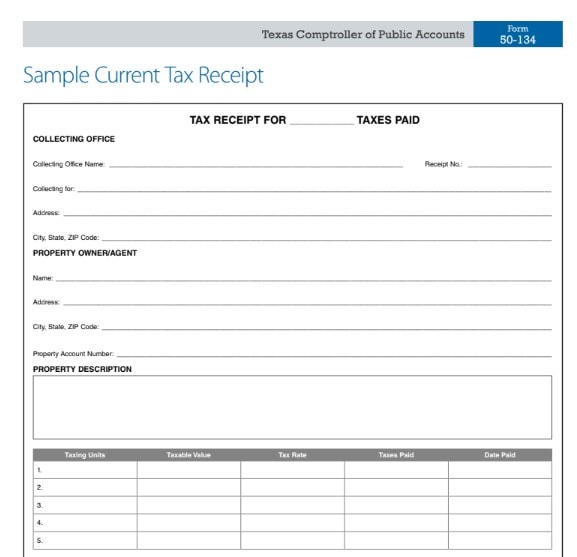

How Long Do I Keep Tax Receipts

For tax receipts, it's smart to keep them for 3 years. The tax office might want to check your taxes within this time. Tax receipts prove what you spent and can help if the tax office has questions.

Sometimes, you need to keep receipts longer. If you forgot to report the money you made, keep your receipts for 6 years. This is just to be safe if the tax office looks into it.

Receipts are very important if there's a tax audit. An audit is when the tax office checks your taxes closely. Your receipts are proof that your tax return is right. They can show you had the expenses you said you did.

Now, keeping receipts is easier with digital storage. You can scan your paper receipts and keep them as files on your computer or in the cloud. This saves space and makes it easy to find receipts if the tax office asks for them. Digital receipts are just as good as paper ones for the tax office. They make managing your tax receipts simpler and more organized.

Part 2. PDFelement: A Tool for Managing Receipts

PDFelement is a great tool for keeping your receipts organized. It's easy to use and helps you store all your receipts in one place. This is how it can help you:

- Scan and Convert: You can scan paper receipts and turn them into digital files. You can keep your receipts on your computer instead of in a box.

- Organize Easily: With PDFelement, you can put all your receipts in folders. This makes it easy to find them when you need them.

- Edit and Add Notes: Sometimes, you want to remember something about a receipt. PDFelement lets you write notes on your digital receipts.

- Safe and Secure: Keeping your receipts as PDFs means they are safe. You won't lose them, and they won't get damaged like paper can.

- Share and Print: If you need to share a receipt with someone or print it out, PDFelement makes this easy.

Using PDFelement for your receipts helps you stay organized. You can find any receipt quickly. This is very helpful for taxes or checking your spending. It's a simple way to take care of your receipts without much space.

PDFelement’s PDFelement Cloud: Secure and Convenient

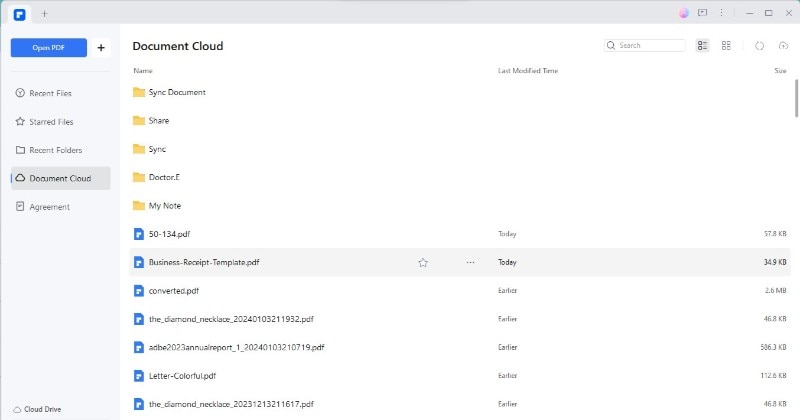

PDFelement's PDFelement Cloud is a great space for storing your receipts safely online. It lets you access your receipts from anywhere, on any device. This is handy for keeping your business receipts organized and easy to find. Here’s why it’s good and how to use it:

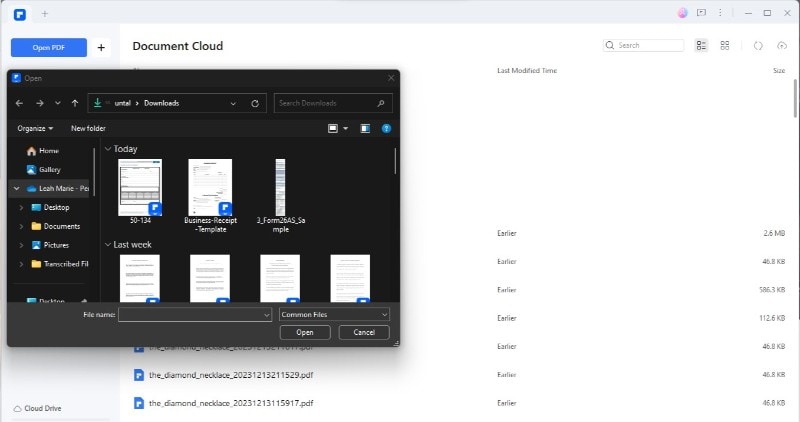

Step1

Open PDFelement on your device. This can be your computer, tablet, or smartphone.

Step2

Sign in to your account. If you don’t have one, you’ll need to make one.

Step3

Look for the "PDFelement Cloud" option. Click on it.

Step4

Choose the "Upload Files" button. This lets you pick the receipts you want to save in the cloud.

Step5

Find the receipts on your device. Select them and click "Open" to start the upload.

Step6

Once your receipts are uploaded, you can see them in PDFelement Cloud. You can open them anytime to view or download them.

Following these steps, you can keep your receipts organized and easily found. This is very helpful for managing your expenses and preparing for taxes.

Here's why you should use PDFelement Cloud for receipts:

- Lots of Space: You get a lot of storage space for free. You can keep many receipts without running out of room.

- Safe and Private: Your receipts are kept safe. You can trust that your information is protected.

- Easy to Access: You can access your receipts from any device, anytime. This is very helpful if you need to find a receipt quickly.

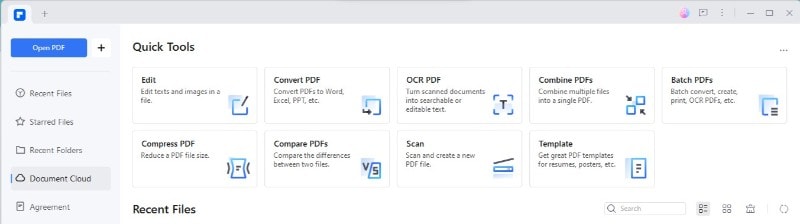

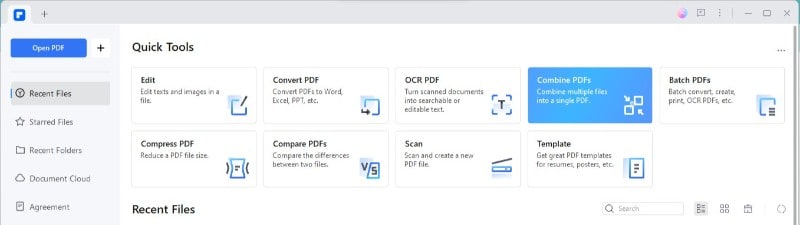

Combine Feature in PDFelement: Simplify Your Receipts

The Combine feature in PDFelement is a handy tool for merging multiple receipts into one PDF. This can make your financial records much easier to manage. You create a document that's easier to share, send, and store by compiling all your receipts.

Step1

Open PDFelement on your device. This works on computers, tablets, and phones.

Step2

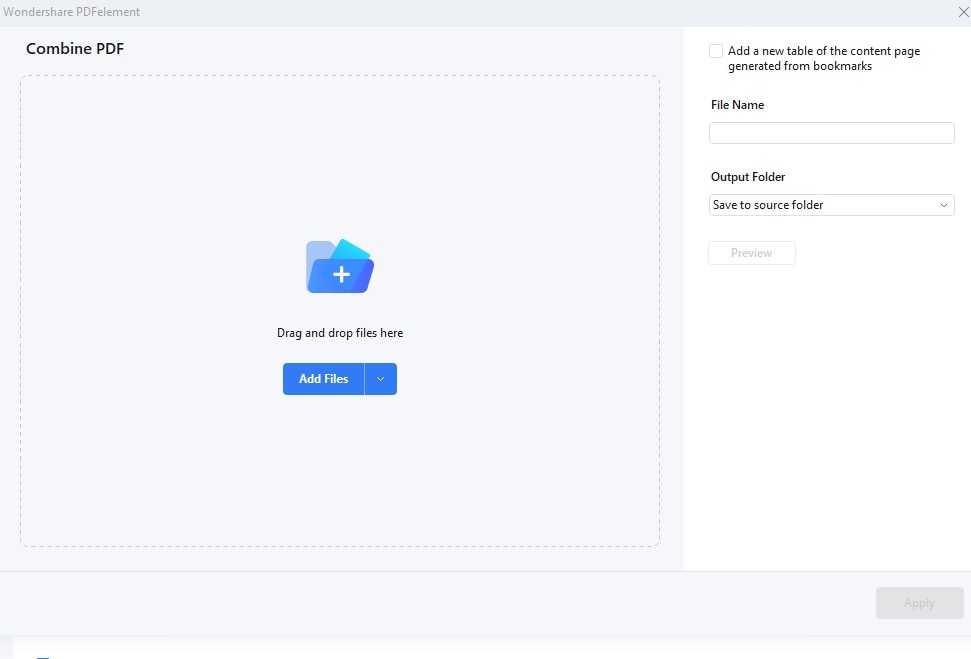

Click on "Combine PDFs" on the homepage. Or, you can go to "Tools" and then choose "Combine."

Step3

Drag and drop the files you want to combine into the Combine window. You can add PDFs, images, and other file types.

Step4

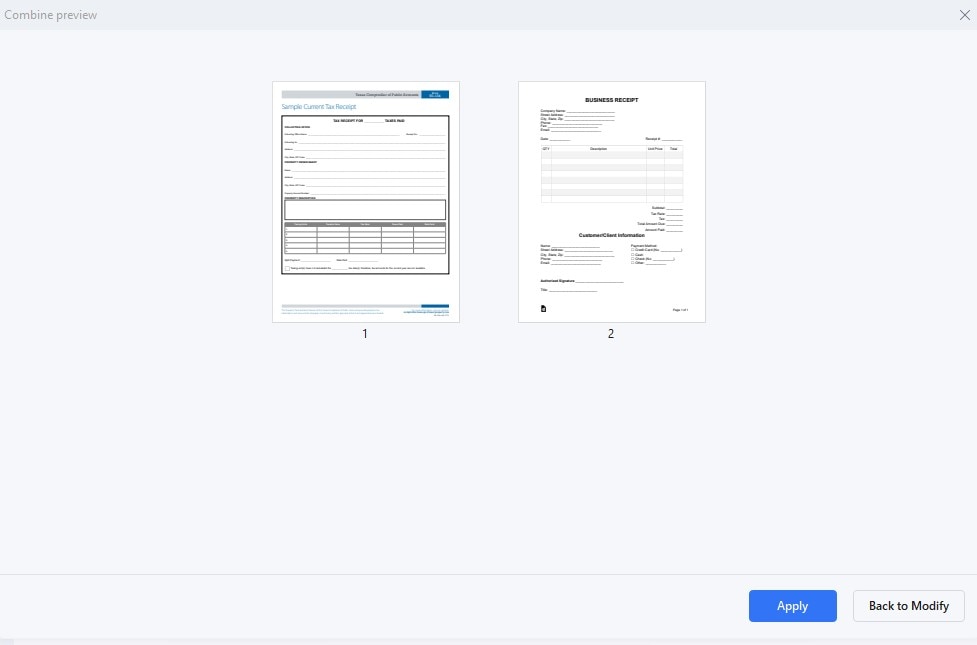

Click "Apply" to merge the files into one PDF. This might take a few moments.

Step 5 (Optional)

Once your files are combined, the new PDF will open automatically. The "Organize" option can rearrange, delete, or rotate pages.

Here are some benefits of combining your receipts:

- Simplifies Organization: Having all your receipts in one document makes tracking your spending easier.

- Saves Time: Instead of searching through dozens of files, you have everything in one place.

- Easier Sharing: When you need to share your expense records, it's much simpler to send one file.

Combining your receipts into one PDF with PDFelement keeps you organized and makes it easier to handle financial documentation, whether for personal or business purposes. This streamlined approach to document management can save you time and reduce clutter in your records.

Conclusion

Keeping your receipts organized is key for managing money and taxes. Tools like PDFelement make it easier. You can save, combine, and manage receipts with just a few clicks. Whether for personal use or business, these tips help you stay on top of your finances. Start using these strategies today to make your financial record-keeping simpler and more secure.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure