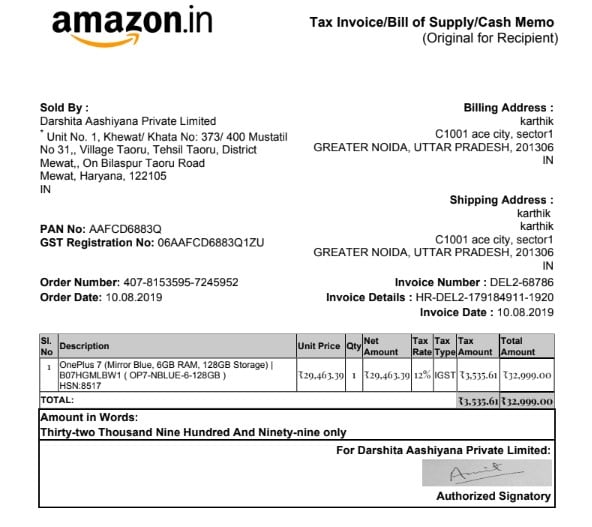

Keeping track of receipts is key when it comes to taxes, especially if you work for yourself or have money coming in from different places. For many, the question is: should I keep grocery receipts for taxes? The simple answer is that it depends. For most people, grocery receipts might not directly impact your tax returns unless you're self-employed and certain purchases are for your business. However, keeping these receipts can be crucial for those who are self-employed or have varied income sources. They can help you understand your spending and potentially find tax deductions.

One tool that can help organize your tax documents is PDFelement. It's easy to use and can keep your receipts in order. With PDFelement, you can scan, store, and manage all your tax-related documents in one place. This makes handling your taxes more straightforward.

In this article

Part 1. Understanding Which Receipts to Keep for Personal Taxes

When it comes to taxes, knowing which receipts to keep is important. Not all receipts are equal, but many can help you come tax time. Here's a simple guide on what to hold onto:

- Business Expenses: If you're self-employed, keep receipts for anything you buy for your business. This includes office supplies, business meals, and travel expenses.

- Home Office Costs: If you work from home, expenses like internet bills or home office furniture can count. Keep those receipts.

- Education Expenses: Money spent on education that helps your work can sometimes be deducted. Save receipts for courses or workshops.

- Healthcare Costs: Receipts for medical expenses, including insurance premiums, can be important if they exceed a certain part of your income.

- Charitable Donations: If you give money or goods to charity, those receipts can lower your tax bill.

- Grocery Receipts: Typically, grocery receipts aren't needed for personal taxes. But, if you're self-employed and buy food for your business, like for a catering service, keep those receipts.

These deductions are especially key for those with 1099 income or those not from a traditional employer. You might owe more at tax time since taxes aren't automatically taken out of your pay. Deductions can lower how much you owe. Think of deductions as business-related expenses that reduce your taxable income. The more valid expenses you can deduct, the less you might owe in taxes.

Remember, the key is whether the expense is for your business. Personal groceries or a coffee maker for your home don't count. But it's a valid expense if it's for the business, like coffee for a client meeting.

Part 2. The Role of Receipts in Tax Preparation and Deductions

Receipts play a big part in preparing your taxes and figuring out deductions. They are like little proofs of your spending, especially on things that can lower your tax bill. Let's explain how some receipts, even groceries, might affect your taxes.

First, think about deductible expenses. These are costs that the tax rules say you can subtract from your income before calculating how much tax you owe. Examples include:

- Business Supplies: Anything you buy to keep your business running. This could be paper for your printer or software you use for work.

- Travel Costs: Money spent on travel for work, not just your daily commute, but going to conferences or meeting clients.

- Home Office Expenses: If you have a space at home just for work, some costs, like a part of your rent or electricity, can be deducted.

- Professional Development: Classes or seminars that help you in your job can be deductible.

Now, grocery receipts are usually not deductible for most people. But those can count as business expenses if you're self-employed and buy food for a business event or as part of your product (like ingredients if you're a baker).

Non-deductible items are personal expenses. This means things like your home groceries, clothes (unless they are uniforms or specialized clothing for work), and vacations. These costs don't affect your taxes.

Keeping your receipts organized helps you see what deductions you can claim. It makes tax time less stressful and can save you money. By knowing what receipts to keep, you make sure you're only claiming what's allowed. This keeps you in good standing with tax laws and maximizes your potential deductions.

How To Efficiently Keep Receipts for Taxes

Keeping receipts for taxes doesn't have to be hard. Here are some easy tips to help you stay organized all year:

- Don't wait until tax time to organize your receipts. Keep track of them as you get them.

- Sort your receipts into categories like office supplies, travel, and meals. This makes it easier to find what you need later.

- Paper receipts can fade or get lost. Scanning them or taking photos means you have a digital copy that's easy to keep safe.

- Make sure your digital receipts are saved in multiple places, like your computer and a cloud service. This way, you won't lose them if something goes wrong.

- Every month, take a little time to make sure all your receipts are collected and organized. This keeps the job small and manageable.

PDFelement is a great tool for managing your receipts. With it, you can easily scan and store your paper receipts as digital files. You can also organize them into folders in the app, making it simple to keep track of different types of expenses. Plus, PDFelement lets you quickly search your receipts to find what you need without digging through piles of paper.

By using these tips and tools like PDFelement, you'll make tax time a lot less stressful. Keeping your receipts organized means you're ready to handle your taxes efficiently, and you might even save some money by not missing out on deductions. Start organizing your receipts now, and you'll thank yourself later.

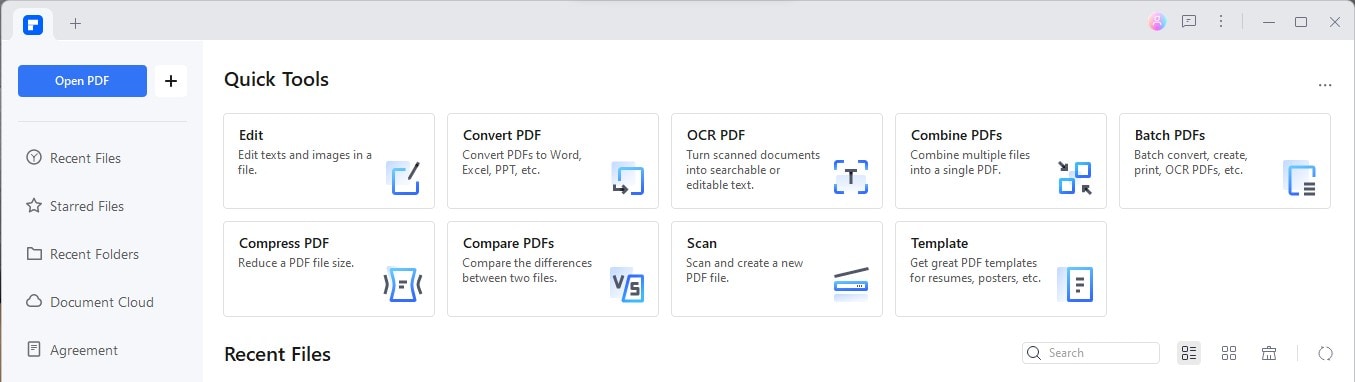

Part 3. Using PDFelement for Tax Receipts

PDFelement is a handy tool that makes dealing with tax receipts much easier. It lets you turn all your paper receipts into digital files. This means you can say goodbye to keeping boxes of paper and hello to a neat digital archive. Here's why PDFelement is great for tax preparation:

- Easy to Use: You don't need to be a tech whiz. PDFelement is simple, making it easy to scan and save your receipts.

- Organize Your Receipts: With PDFelement, you can create folders for different expenses. This helps you stay organized and find receipts quickly when you need them.

- Safe and Secure: Keeping your receipts digital means they're safe from getting lost or damaged. PDFelement stores them securely, so you don't have to worry about losing important info.

- Access Anywhere: Once your receipts are in PDFelement, you can access them anywhere. Need to check a receipt while you're out? No problem.

- Make Tax Time Easier: When it's time to do your taxes, having all your receipts sorted and easy to find makes everything smoother. You can easily pull up what you need for deductions without digging through piles of paper.

Using PDFelement for your tax receipts saves time and stress. It helps you keep everything in order so you're ready for tax season without the hassle.

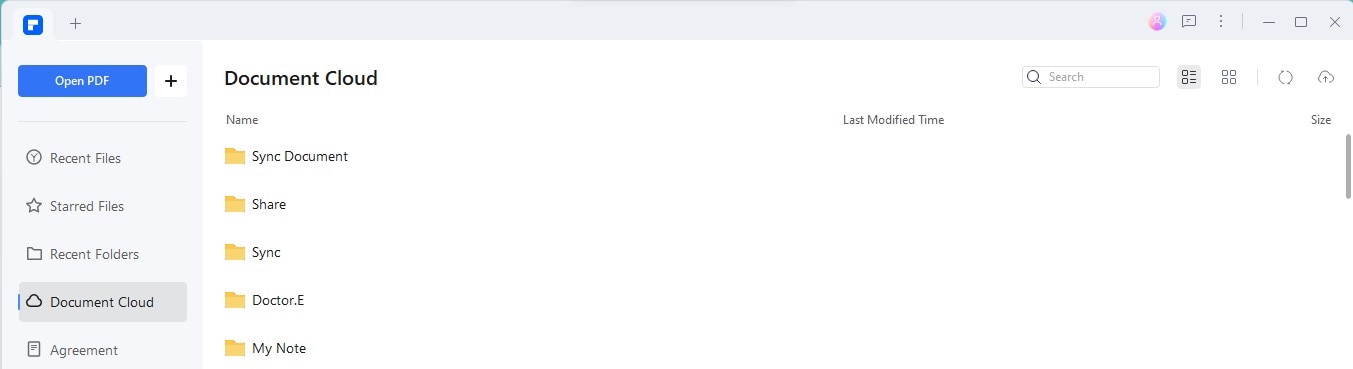

Utilizing PDFelement's PDFelement Cloud for Receipt Storage

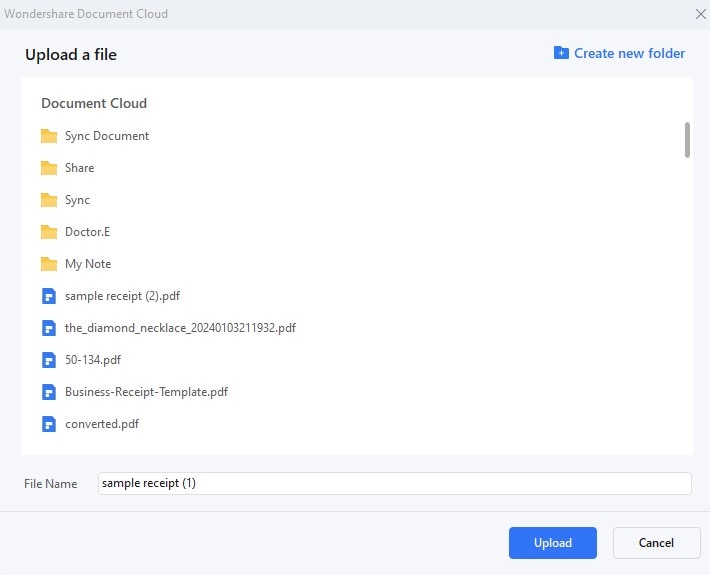

PDFelement's PDFelement Cloud is a smart choice for keeping your receipts safe online. You can reach your receipts anytime, from any gadget. This is super useful for sorting your business receipts and finding them fast. Here's a simple guide on how to upload your receipts to the cloud:

Step1

Open the app on any device you use, like your computer, tablet, or phone.

Step2

You need to sign into your account. If you don't have one yet, setting one up is easy.

Step3

Look for a "PDFelement Cloud" choice and click on it.

Step4

There's a button that says "Upload Files." Hit that button to pick the receipts you want to save.

Step5

Go through your device, pick the receipts you wish to upload and click "Open" to upload them.

Step6

Now, your receipts are in the PDFelement Cloud. You can look at them, download them, or share them whenever you want.

Why put your receipts in PDFelement Cloud? It's handy because you get lots of room to store your receipts without filling up your device. It's also secure, keeping your private stuff private. Plus, you can access your receipts from anywhere, whether at home or on the go. This makes managing your money and getting ready for tax time a breeze.

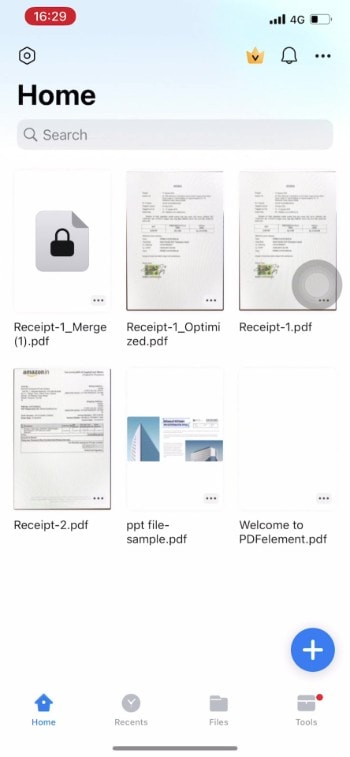

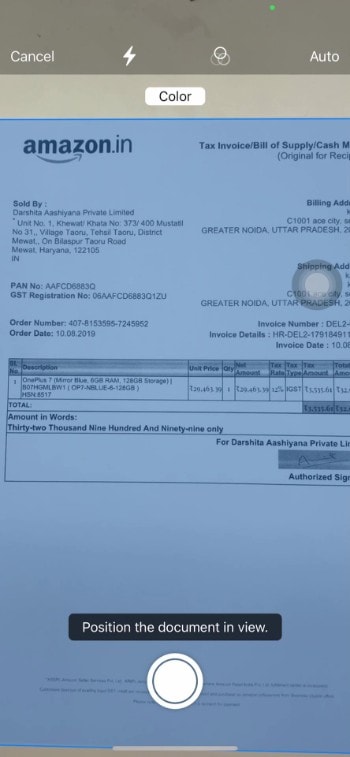

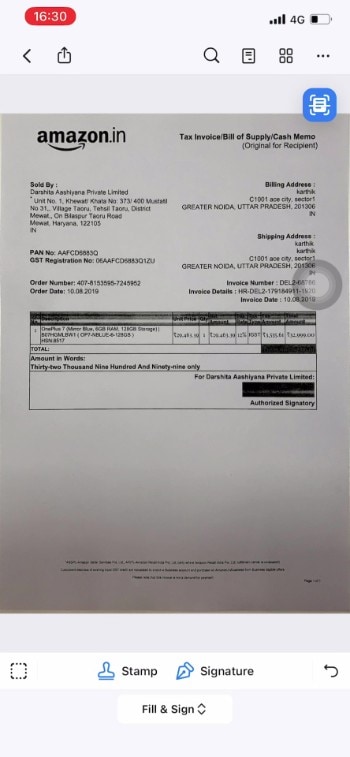

Digitizing Receipts with InstaScan

PDFelement has a cool feature called InstaScan that makes turning paper receipts into digital ones easy. Here's how you can use it:

Step1

First, start PDFelement on your phone.

Step2

There's an option to scan a new document. Tap on that.

Step3

Now, snap a photo of your receipt. Make sure it's clear, and everything on the receipt is visible.

Step4

If necessary, crop the photo or adjust it so everything looks right.

Step5

The app then changes your photo into a PDF file. You can save it wherever you want, like in a specific folder for tax receipts.

Using InstaScan is handy. It helps you quickly change all those paper receipts into digital ones without a hassle. This means no more worrying about losing receipts or dealing with faded ink. Plus, organizing and finding them when needed is a breeze once they're digital.

Combining Multiple Receipts with PDFelement

PDFelement's combined feature is great for putting all your receipts into one file. This makes keeping track of your spending much easier. Here's how you can do it:

Step1

Start the app on any device you have, like your computer, tablet, or phone.

Step2

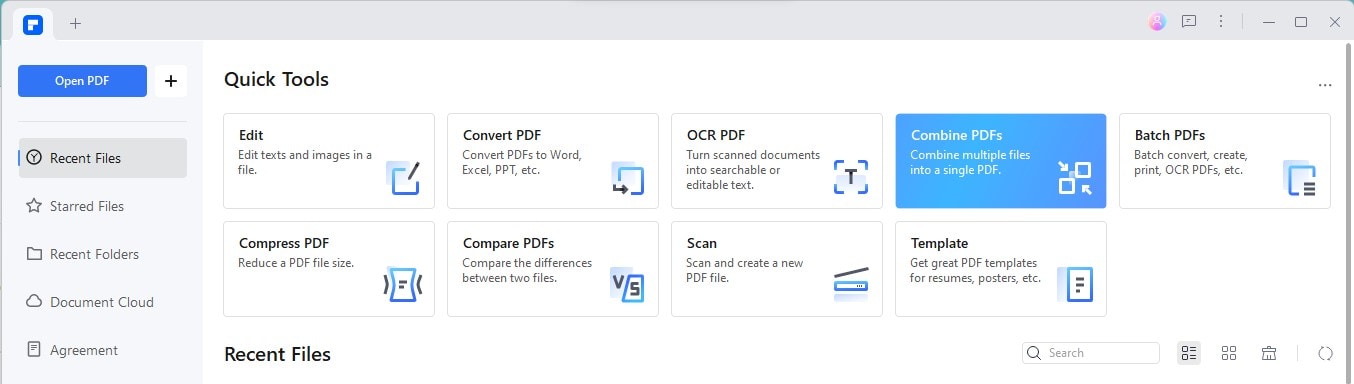

On the main screen, look for a button that says "Combine PDFs." You can also find this option under "Tools."

Step3

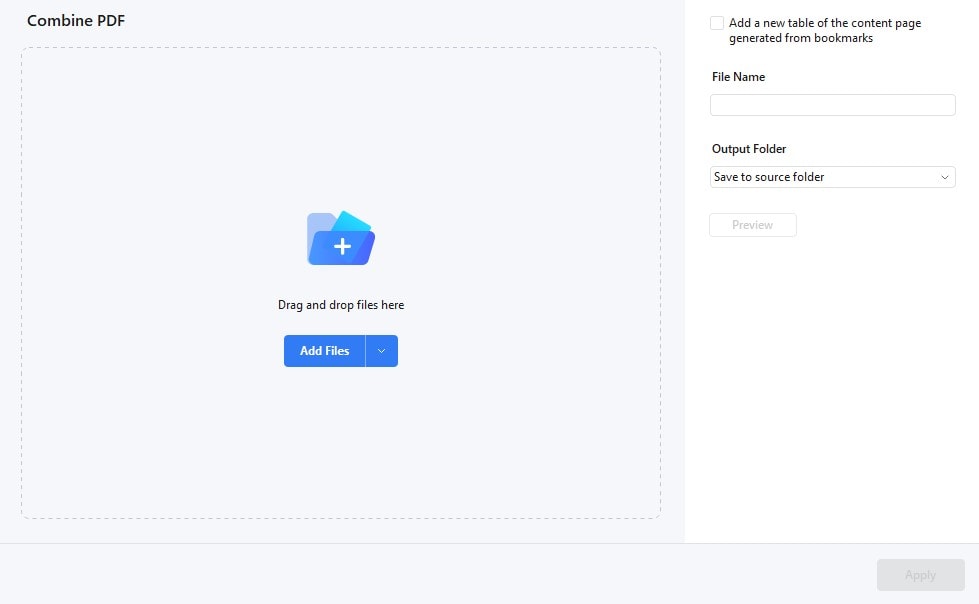

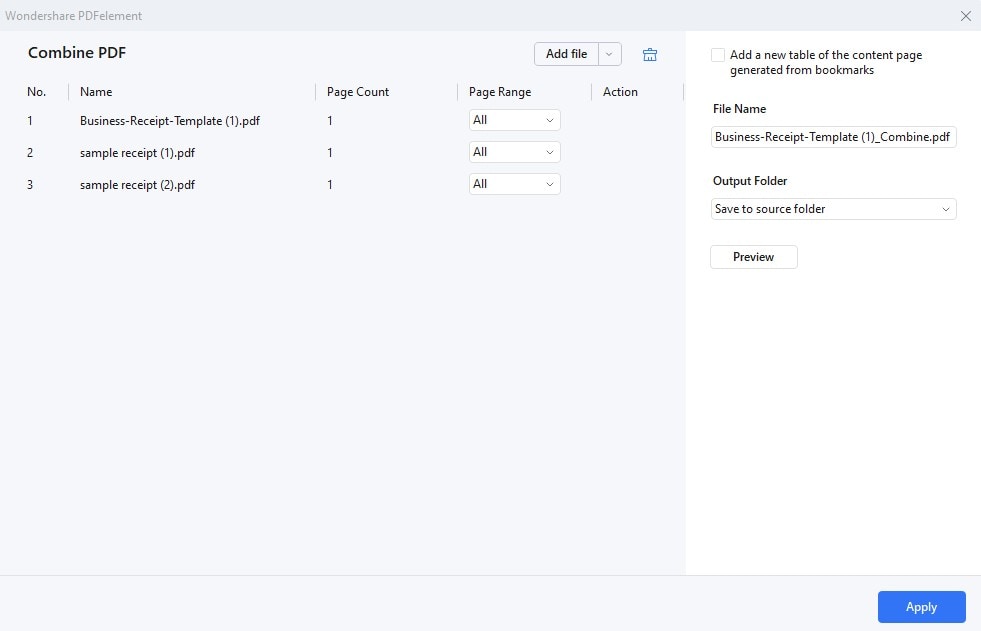

Now, drag the receipts you want to merge into the open window. You can add different types of files, not just PDFs.

Step4

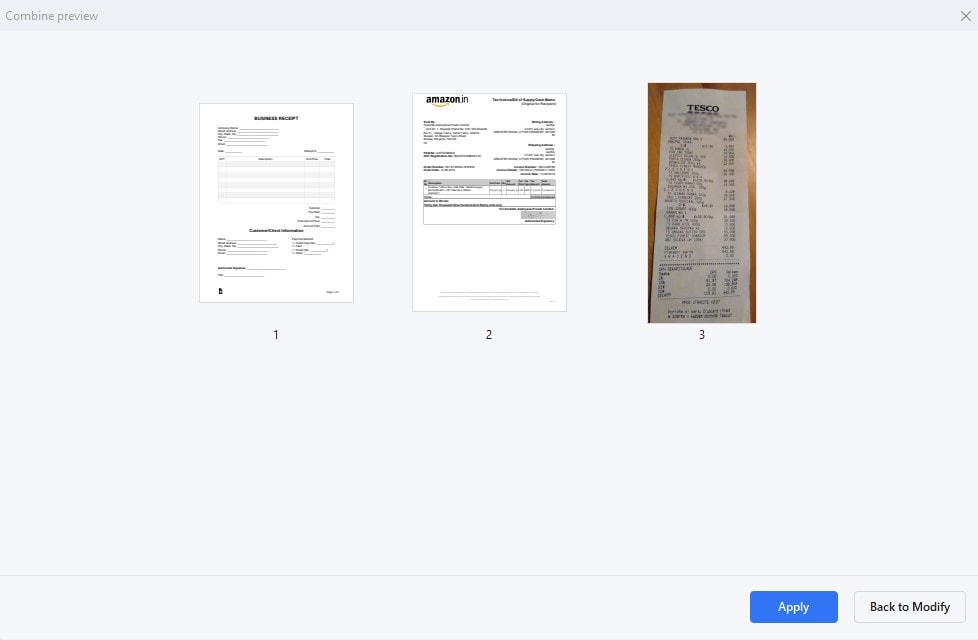

Click "Apply" to start combining your files into one PDF. Wait a bit while it processes.

Step5

Once combined, the new PDF will open. You can use the "Organize" feature to move pages around, delete them, or rotate them as needed.

Why is this useful? Combining receipts into one document helps keep your financial records tidy. It's easier than handling lots of individual files. You save time because you're not searching through tons of documents. If you need to share your spending records, sending one file is simpler than many. Using PDFelement to combine your receipts into a single PDF helps you stay organized and makes managing your finances easier.

Conclusion

Keeping receipts organized is important for managing your taxes. Tools like PDFelement make this easier by letting you scan, save, and combine receipts in one place. This helps you stay ready for tax time, find deductions, and keep your finances in order. Use these tips and tools today to make tax season less stressful and keep your financial records neat.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure