Banks and financial services have existed before money existed. They were born with the purpose of carrying out simple exchange and credit operations using mainly gold and valuable seeds as currency but, over time, the needs of the market and state regulations made it necessary for banks to become more complex organizations that were capable of keeping records of all movements made for tax purposes.

As time went by and thanks to technological advances, banks continued to improve their management methods and automate many of their services. However, when dealing with financial processes, it was not possible to automate everything.

In this article

Part 1. Features of Bank Services

Banks are for-profit organizations because they manage to generate profits through the interest and commissions they charge for their services, so they constantly seek to acquire new clients. For this reason, banks began to offer new services such as:

Checks: Although thousands of people already had bank accounts to manage their money, their users had problems when they wanted to pay with the money from their bank accounts to people who did not have a bank account yet. A check is a document that asks the sender's bank to pay a certain amount to another person or company.

Deposits: Deposits are essentially the reason banks exist. It is the money that people do not need to use immediately and prefer to keep in a bank account to acquire the management advantages offered by banks. Thanks to constant technological advances, it became possible to make a deposit through an ATM.

Debt: Banks were already able to manage thousands of credit accounts simultaneously and this had created a new ecosystem for money management. Despite the fact that banks offered payment options to people without bank accounts, a new scheme was developed. In this case, banks charge a fee for the use of this service that allows their users to use the advantages of a bank account but without the payment scheme of a credit account.

Overdrafts: Thanks to the information collected from bank accounts, banks offered their clients the possibility of generating a small debt. That is, banks know exactly the constancy and amount of money that their users deposit in their accounts, which allows them to use more money than they really have at that time to eventually pay it with an interest fee.

Interbank transfers: The popularization of banking services spread rapidly around the world and, as a result, hundreds of banks emerged around the world, so banks around the world began to offer interbank transaction services to allow their users to make your payments, transfers and deposits without your bank accounts being a limitation.

Currency exchange: Since banks have been in existence, one of their main services has been currency exchange and thanks to the events that occurred after the Bretton Woods conference, the creation of the World Bank and the IMF, the dollar is used as currency of reference for the correlation of the value of currencies.

Consulting services: Since the use of the credit system began to become popular, banks began to offer consulting services. They hire financial, legal and market experts who advise their clients on investment, industry, trade, income, taxes, etc.

Advance loans: Although, loans have existed before banks existed. Banks study their clients and, based on their credit history, offer them short, medium or long-term loans, according to their needs and possibilities.

All of these services were very well received by the people and were quickly adopted. However, there have always been obstacles to overcome, the main two being safety and simplicity. This is where technology plays a very important role. For some years now, banks have done their best to solve this problem through the digital resources and tools that are available to everyone today, offering increasingly convenient services.

Part 2. How Does Bank Provide More Convenient Services

Thanks to the great advances in the field of technology, computer security, the growing popularity of the internet and the use of smart devices, it has been possible for banks to offer increasingly sophisticated services that allow their users to enjoy all services to which they are used but remotely, through their websites and mobile applications.

This great achievement may go unnoticed nowadays but it brought with it enormous advantages at the time that are not only related to comfort. Such as:

Reduce paper processes

In the mid-1970s and 1980s, around the world began to talk about a phenomenon caused by increasing pollution in the environment. Climate change, global warming and environmental pollution had become issues of public concern and since then, many companies began to take measures to help reduce the pollution generated by their business activities. Thanks to the digitization of information, it was possible to considerably reduce most of the documentation that banks issued. Initially, users could request copies of their account statements, request vouchers and records in person, by calling or emailing their banks. Eventually, banks adopted mobile app technology to strengthen security, facilitate these procedures, and reduce paper waste. So, currently, you can use their mobile applications to request a digital version of any document related to your bank account.

Make agreements easy!

Some of the most requested financial services require a signed agreement that stipulates the terms and conditions of the service provided and at the same time legally supports both parties. Thanks to the digital tools that we have today, it is possible to perform this type of procedure in just a few seconds. Currently, most of these procedures are assisted by mobile banking applications and it is not necessary to go to a bank. In some cases, when it is necessary for a document to have an official signature, the user can place a digital signature on the PDF document that the bank provides or can print a copy, sign it and scan it to convert it back into a digital document.

Be flexible: both physical and digital channels

Banks do their best to ensure that all their users can access their services in the way that they like best. Physical media or digital media, currently, both are valid. It all depends on the preference and needs of the user.

Every time people use a banking service, either by going to a bank or through digital media, a digital version of all legal and accounting documentation is automatically generated simultaneously. This allows any user to request their information in PDF format through digital means or a physical copy at their bank.

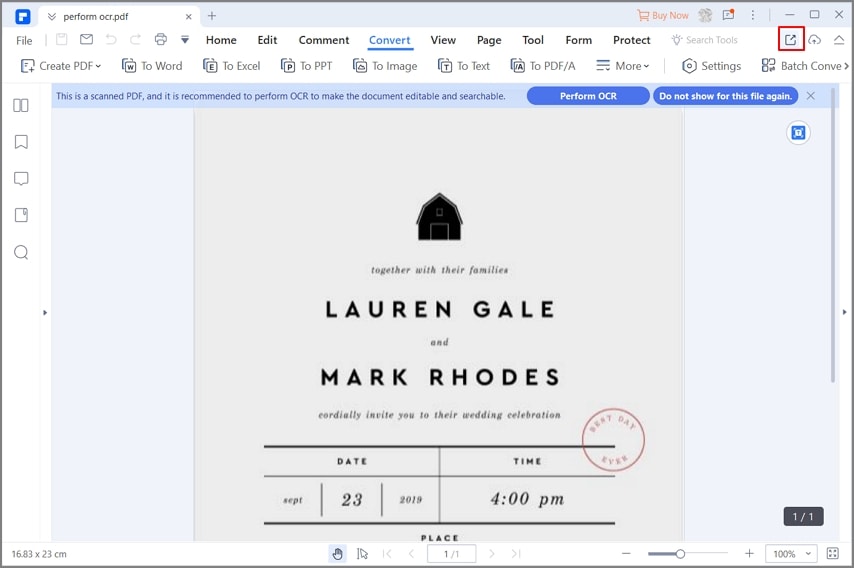

Choose PDF solution-PDFelement

As I mentioned earlier, all documentation related to users' bank accounts is generated in PDF format. This format is capable of displaying the content with total precision, regardless of whether it is being opened from a smartphone, laptop, computer or any other electronic device and it also guarantees that it will be displayed exactly the same when printed on a sheet of paper. In addition, there is specialized software for managing PDF files, with which you can organize, protect and sign your documents as Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement. Below I will show you how it works.

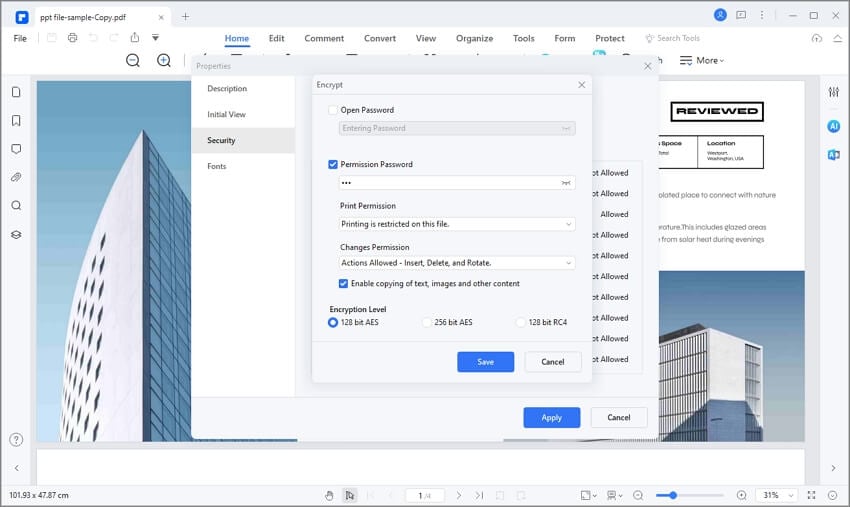

Protect Files

A document that has information related to a bank account has private information of the user. With PDFelement you can set an access password so that no one can misuse your private information.

Protect Data

Nowadays, it is very common to hire accounting and tax advisory services, so it is likely that at some point you will have to share your documents. PDFelement allows you to blackout the document so that you do not expose your private information at any time.

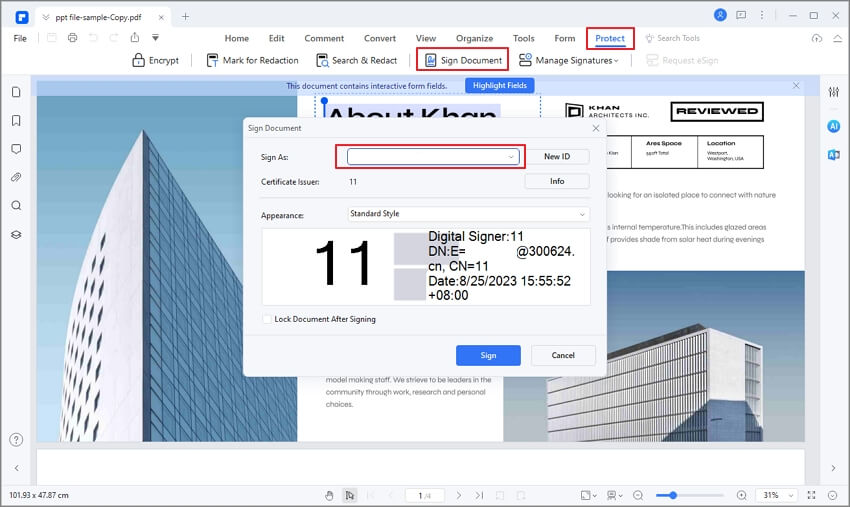

Sign Documents

As I mentioned earlier, you can sign a PDF document in two ways, the first is by placing an image with your signature and transparent background, while the second way is by printing, signing and scanning it. On the other hand, PDFelement allows you to sign directly on the digital document. You can use the touch screen of any of your devices to make your signature accurately and link it to your account, in this way you will get an excellent quality signature in just seconds.

Closing Words

Banking services offer enormous advantages. Pay for household services, make purchases online, buy a car, rent an apartment, make investments or simply keep your money in a safe place. At present it is practically impossible not to make use of these services, so it is highly advisable to have a management tool like PDFelement that allows you to protect and sign your bank documents with just a couple of clicks.

Home

Home