Real estate contracts are key to buying and selling property. They are formal agreements that define the terms between the buyer and seller. These contracts are important because they clearly outline what is expected from each party. This helps prevent misunderstandings and disputes.

An option contract in real estate is a special kind of agreement. It gives a potential buyer the right to purchase a property at a set price within a certain period. The buyer pays the seller an amount to hold this option. This kind of contract is useful in the market because it allows buyers to secure a price and decide later if they want to complete the purchase.

In this article

Part 1. What is an Option Contract in Real Estate?

An option contract in real estate is a special agreement between a seller and a potential buyer. It allows the buyer to buy a property at a set price within a specific time. The buyer pays the seller a fee for this choice. This fee is not returned if the buyer decides not to buy the property. However, if the buyer chooses to buy, this fee often counts towards the purchase price.

There are mainly two types of option contracts:

- Option to Purchase: This contract gives the buyer the right to purchase the property at any time during a set period at a price agreed upon when the contract is signed. The buyer can decide to buy the property before the time runs out.

- Option Agreement: This is a more detailed contract. It includes all the terms of the agreement, like the price, the length of the option period, and other conditions that must be met before the final purchase.

Both contracts are useful for buyers who might need time to arrange financing or want to lock in a price before prices rise. They also help sellers because they get to keep the option fee if the buyer doesn’t go through with the purchase.

Importance of Option Contracts

Option contracts in real estate offer strategic benefits for both buyers and sellers. For buyers, these contracts provide a chance to secure a property at a current price, even if they are not ready to buy it immediately. This is helpful in a market where prices might rise. It allows buyers to plan and arrange their finances without fearing losing the property to someone else.

For sellers, option contracts mean they get a fee from the buyer, which they can keep if the buyer decides not to purchase the property. This fee is extra income compensating for keeping the property off the market during the option period.

Financially, these contracts help manage risks. Buyers risk losing the option fee if they choose not to buy the property. However, this risk is often worth it compared to the potential cost of increasing property prices. For sellers, the risk is that if property prices rise significantly, they are still locked into a set price. However, the immediate benefit of the option fee and potential sale can outweigh this risk. This makes option contracts useful for both parties to manage their financial interests.

Part 2. Examples of Option Contracts in Real Estate

Option contracts are particularly useful in certain real estate scenarios, like development projects or uncertain market conditions.

For development projects, developers may use option contracts to secure land before building. They might not be ready to buy immediately, as they need time to get permits and funding. An option contract lets them lock in the land at a current price. This way, they can plan their project knowing the land will be available without the pressure of immediate full payment.

Buyers and sellers find option contracts helpful in uncertain market conditions, such as fluctuating property prices. Buyers can secure a price when the market is low, protecting themselves against future price increases. This is especially beneficial if they believe the market will improve but are not ready to commit fully.

On the other hand, sellers benefit from option contracts in unstable markets by earning the option fee. This fee compensates them while they wait to see if the buyer will go through with the purchase, providing some financial security in a volatile market.

When to Use an Option Contract

Options contracts are ideal in several scenarios in real estate. One key scenario is when a buyer is interested in a property but isn't ready to purchase immediately. This might be due to the need to arrange financing or wait for another property to sell. An option contract secures the property for the buyer during this time.

Another good time to use an option contract is when a buyer or developer needs to secure multiple properties for a large project, like a housing development. They can negotiate option contracts to hold these properties until they can proceed with the full project.

Legal considerations are important with option contracts. Both parties must clearly understand and agree to the terms, such as the duration of the option, the price, and the conditions under which the option fee is forfeited or applied to the purchase price. It's crucial to have a lawyer review the contract to ensure that all legal requirements are met and that the contract is enforceable.

The right timing for an option contract is when both parties want some flexibility in the transaction. This contract type offers security for the seller and options for the buyer, making it useful when immediate decisions are not feasible.

Part 3. How Wondershare PDFelement Facilitates the Writing of Option Contracts

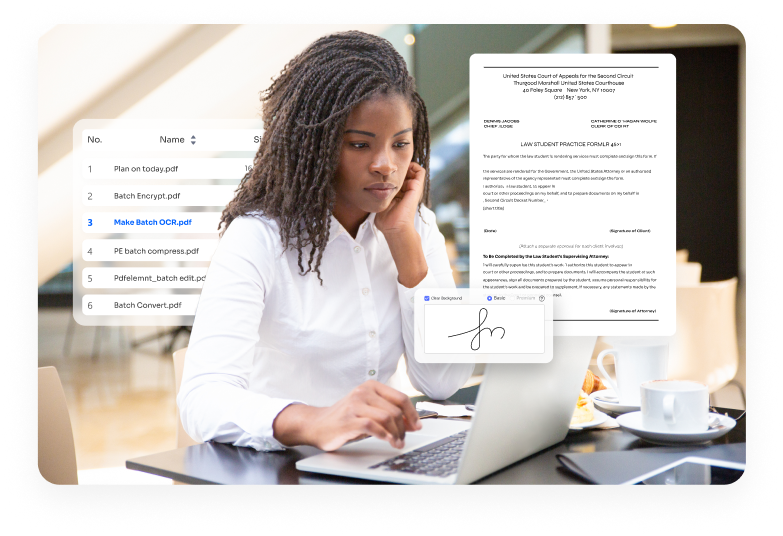

Wondershare PDFelement - PDF Editor Wondershare PDFelement Wondershare PDFelement is a powerful tool to help real estate professionals manage option contracts more efficiently. This software has several features that are very helpful for creating, editing, and organizing documents.

Here’s how to use PDFelement’s online features for option contracts:

- Templates: PDFelement offers a range of templates, including those for option contracts. Start by choosing a template that fits your needs. This saves time and ensures that all the necessary legal points are covered.

- PDF Merge: If your option contract has multiple documents or attachments, PDFelement can merge them into one file. This makes managing and reviewing the contract as a single document easier.

- Convert: You can convert documents from other formats into PDFs or convert your PDF into other formats. This is useful if you receive contract components in different formats or send them to others requiring a specific format.

- E-Sign: PDFelement allows you to send documents to other parties for electronic signatures. This feature is crucial for legally binding option contracts without needing in-person meetings.

- Compress: High-quality documents can be large. PDFelement can compress these files to make them easier to email and store without losing clarity.

- Organize: Rearrange, add, or delete pages in your option contract as needed. This feature helps in customizing the contract to specific deals or updates.

- AI Tools: Use the AI tools to quickly fill in or extract data from contracts. This reduces errors and speeds up the process.

The newly launched online features of PDFelement are designed to streamline the contract management process. They allow real estate professionals to handle contracts more efficiently from anywhere, enhancing productivity and ensuring that contract handling is as smooth and error-free as possible.

How to Write an Option Contract With PDFelement

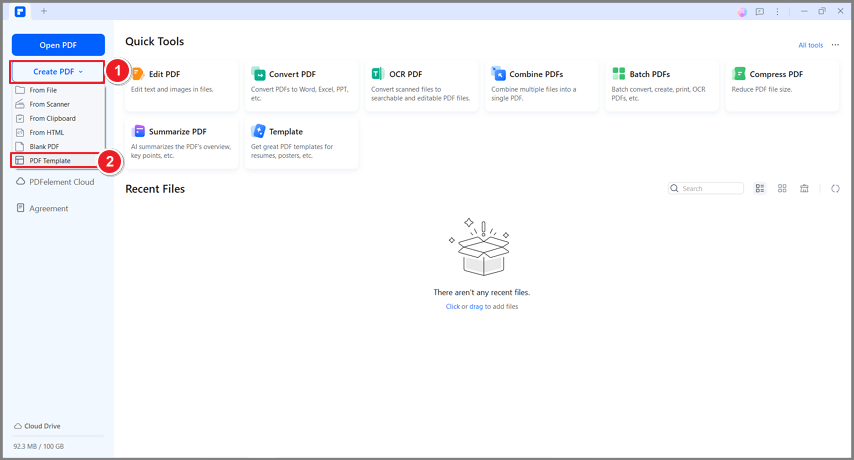

Writing an option contract with Wondershare PDFelement is straightforward. Here’s a step-by-step guide to help you draft an effective option agreement:

Step 1

Open PDFelement and select a template for an option contract. This template already has the basic structure and important sections, saving you time.

Step 2

Fill in specific details like the names of the buyer and seller, property details, and the option fee. Make sure to adjust any default terms to fit your specific agreement.

Step 3

Add Legal Clauses:

- Price Clause: Specify the price agreed upon for the property.

- Duration Clause: Clearly state the timeframe for the buyer to exercise the option.

- Payment Details: Outline how and when the option fee and subsequent purchase price will be paid.

- Conditions: Include any conditions that must be met for the contract to be valid, such as passing inspections or obtaining financing.

Step 4

Carefully review the contract to ensure all information is correct and all necessary clauses are included. Use PDFelement to edit and rearrange sections as needed.

Step 5

Send the draft to the other party for review. Once both parties agree, use PDFelement’s e-sign feature to have the contract signed electronically, making it legally binding.

Step 6

Save the finalized contract in PDFelement. You can also use the software to securely share the document with other stakeholders, like lawyers or real estate agents.

Following these steps with PDFelement simplifies drafting an option contract, ensuring all legal terms are correctly included and the document is professional and legally binding.

Conclusion

Option contracts in real estate are powerful tools that offer flexibility and security for both buyers and sellers. Using these contracts effectively can help secure properties at agreed prices and manage risks. Technological tools like Wondershare PDFelement enhance this process by providing templates, easy document editing, and e-signature capabilities. These features ensure that contracts are clear, legally binding, and easy to manage.

G2 Rating: 4.5/5 |

G2 Rating: 4.5/5 |  100% Secure

100% Secure